Latest Content > US Real Estate Investing Made Easy for International Investors

US Real Estate Investing Made Easy for International Investors

The US real estate market has always been a favourite among international investors, and for good reason. The market has shown impressive growth and stability over the years, making it an attractive investment opportunity for both domestic and international investors. However, investing in US real estate can be challenging due to various operational risks involved. This is where tokenized home equity investments come into play.

Making investment in Residential Real Estate As Easy As Buying Stocks

Tokenization is the process of converting real-world assets into digital tokens on a blockchain. These tokens can then be traded and sold on an exchange to other investors.. Tokenized home equity investments are a type of investment where investors buy digital tokens that represent ownership in a property's equity. This process enables investors to have fractional ownership of an asset, making it easier for them to invest in high-value real estate assets. In other words, it is a way of buying a share of the property without the major time commitment and expenses associated with property management. This type of investment has several advantages over traditional real estate investment options such as REITs, mortgage-backed securities, real estate ETFs, and whole property purchase for investment.

Foreign investment in US tokenized home equity investment is gaining popularity due to its many benefits. One of the main benefits is that foreign investors can now easily invest in the US real estate market without having to go through complex legal processes. Tokenization has made it easier for foreign investors to invest in US real estate by reducing barriers such as high capital requirements, lengthy legal processes, and expensive fees. Another benefit of tokenized home equity investment is that it allows for fractional ownership of real estate. This means that investors can invest in a portion of a property, rather than having to buy the entire property. This makes real estate investment more accessible to a wider range of investors, including those with lower capital resources.

One of the core benefits of tokenized home equity investments is long-term home appreciation. Over the past 50 years, US home prices have increased at an average annual rate of 4.9%, making real estate one of the most stable and profitable long-term investments. This appreciation in home prices provides a strong hedge against inflation and a stable source of returns for investors without any operational risk. Additionally, Imagine the opportunity to add yield to appreciation by negotiating bespoke investment deals directly with the homeowner by making an investment offer at a lower price. Essentially, the same equity for a less costly investment and that creates a greater potential ROI. Alternatively, take advantage of homeowner offered equity premiums or equity dividends that also contribute to a great yield on top of appreciation.

As mentioned earlier, tokenized home equity investments are passive, meaning investors do not have to worry about operational risk which includes maintenance, insurance, tenant management, taxes, bylaws, and more. Unlike traditional real estate investments, there is no need for any property management. Since the investment is entirely passive, investors can otherwise focus on building a robust diversified investment portfolio of properties and seeking out the right appreciation and yield.

When compared to other real estate investment options, tokenized home equity investments are also more accessible and cost-effective. REITs, for example, often require a minimum investment of several thousand dollars, and fees can be high. As 2008 laid bare, mortgage-backed securities have demonstrated their extreme high risk and real estate ETFs also come with various operational risks and both require a high level of active management and lack transparency. In contrast, tokenized home equity investments allow investors to participate in the US real estate market with a relatively small investment and without having to worry about operational management or fees. You also have 100% transparency. You know the exact house you have invested in and get access to inspection reports, pictures, and data. You just don't get that with REITs, mortgage backed securities, or ETFs.

The Pitfalls of Whole Asset US Real Estate Investments

Now let's touch on all the legal issues a foreign investor will need to deal with while trying to directly buy wholly owned US real estate for investment purposes:

1. FIRPTA Compliance: The Foreign Investment in Real Property Tax Act (FIRPTA) requires foreign investors to pay taxes on any gains they make from US real estate investments. The tax rate is generally 15% of the gross sales price of the property, but it can be higher depending on the investor's tax status. Foreign investors need to comply with FIRPTA regulations and obtain the necessary withholding certificates to avoid penalties and potential legal issues.

2. Visa Requirements: Foreign investors need to obtain the appropriate visa to buy real estate in the US. Depending on the purpose of the investment, different types of visas may be required. For example, investors who plan to actively manage the property may need an E-2 investor visa, while those who plan to passively invest in the property may need an EB-5 investor visa.

3. Ownership Structures: Foreign investors need to carefully consider the ownership structure of their US real estate investments. Depending on the type of investment and the investor's tax status, different ownership structures may be more advantageous. Some common ownership structures include setting up a US corporation or partnership, using a foreign corporation, or purchasing property through a limited liability company (LLC).

4. State and Local Laws: Each state and locality in the US has its own set of real estate laws and regulations that foreign investors need to be aware of. These laws can vary widely and can impact everything from property taxes and zoning regulations to landlord-tenant laws and building codes.

5. Currency Exchange: Foreign investors also need to consider currency exchange rates when buying US real estate. Fluctuations in exchange rates can impact the overall cost of the investment and can potentially affect the investor's returns.

Foreign investors need to navigate many legal issues when buying US real estate. These issues can range from taxes based on whole property investments and sale to visa requirements to ownership structures to state and local laws, and currency exchange issues. It is crucial for foreign investors to work with experienced attorneys and real estate advisors who can guide them through the complex legal landscape and ensure compliance with all applicable regulations.

The Benefits of Tokenized Securitized Home Equity Investments

The good news with tokenized home equity investments, is that you don't need to worry about these issues. You are only buying a fractionalized share of the property and not the entire asset. Like equities and other securities, these are treated as US sourced capital gains and as such are not taxable under FIRPTA.

Securitized and tokenized home equity sharing agreements are a relatively new type of investment product that allows investors to invest directly in home equity sharing agreements. These agreements are structured so that investors receive a share of the appreciation in the value of the underlying property and any additional yield structured into the deal.

In conclusion, tokenized home equity investments offer foreign investors a safe and stable way to invest in the US real estate market. The long-term appreciation of US homes combined with the passive investment approach makes it an attractive investment opportunity. Compared to other real estate investment options, tokenized home equity investments are more accessible, cost-effective, and come with lower operational risk. With the growth potential of the US real estate market, foreign investors should consider tokenized home equity investments as a viable option for their investment portfolio.

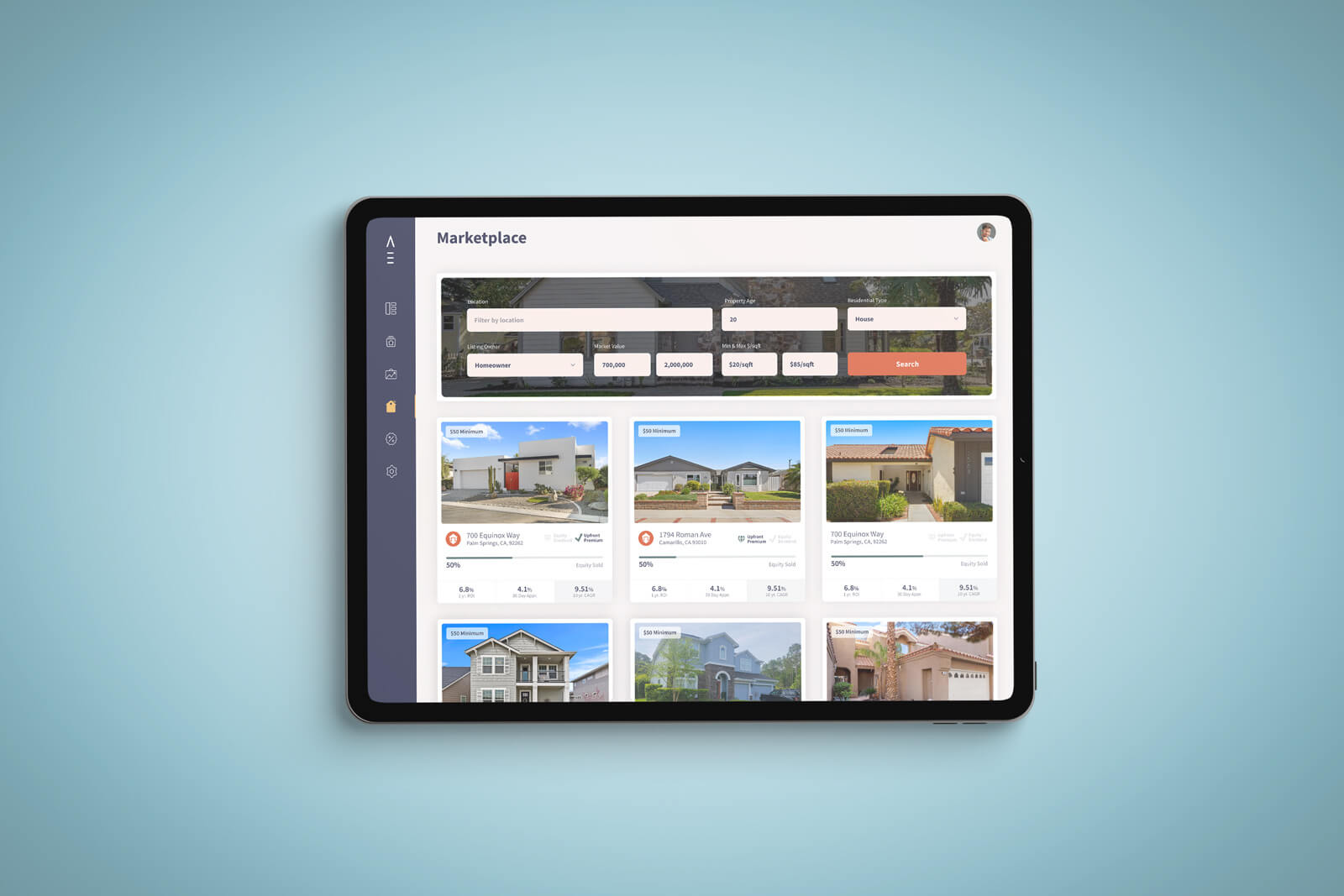

Vesta Equity offers tokenized home equity investments through its marketplace at https://app.vestaequity.net/marketplace

Investment Properties

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video