Latest Content > Building a Portfolio of Tokenized Real Estate Assets – Getting Started

Building a Portfolio of Tokenized Real Estate Assets – Getting Started

Imagine building a portfolio of tokenized real estate assets and managing them the same way you do a portfolio of stocks. A solution that will enable you to buy pieces of real estate on a global level all managed from your account where you can seamlessly tap into a wealth of residential properties and invest by neighborhoods, property types, appreciation, and more.

Real estate is an outstanding investment, and the portfolios of many high-net-worth individuals always includes real estate. It provides balance and solid predictable growth. However, it has never been easy to jump into it as one would with stocks, commodities, and more. Sure, there are REITS, real estate focused ETFs, and mortgage-backed securities but with these you still can’t exercise the optimal control over what exactly those investment vehicles contain, and the lack of transparency can put you at risk. The alternative is to jump in and buy a property outright and assume all the risk. It also means putting all your eggs in one basket with the additional burden of the sweat equity involved in managing the entire property.

“Don’t wait to buy real estate, buy real estate and wait” – T. Harv Eker

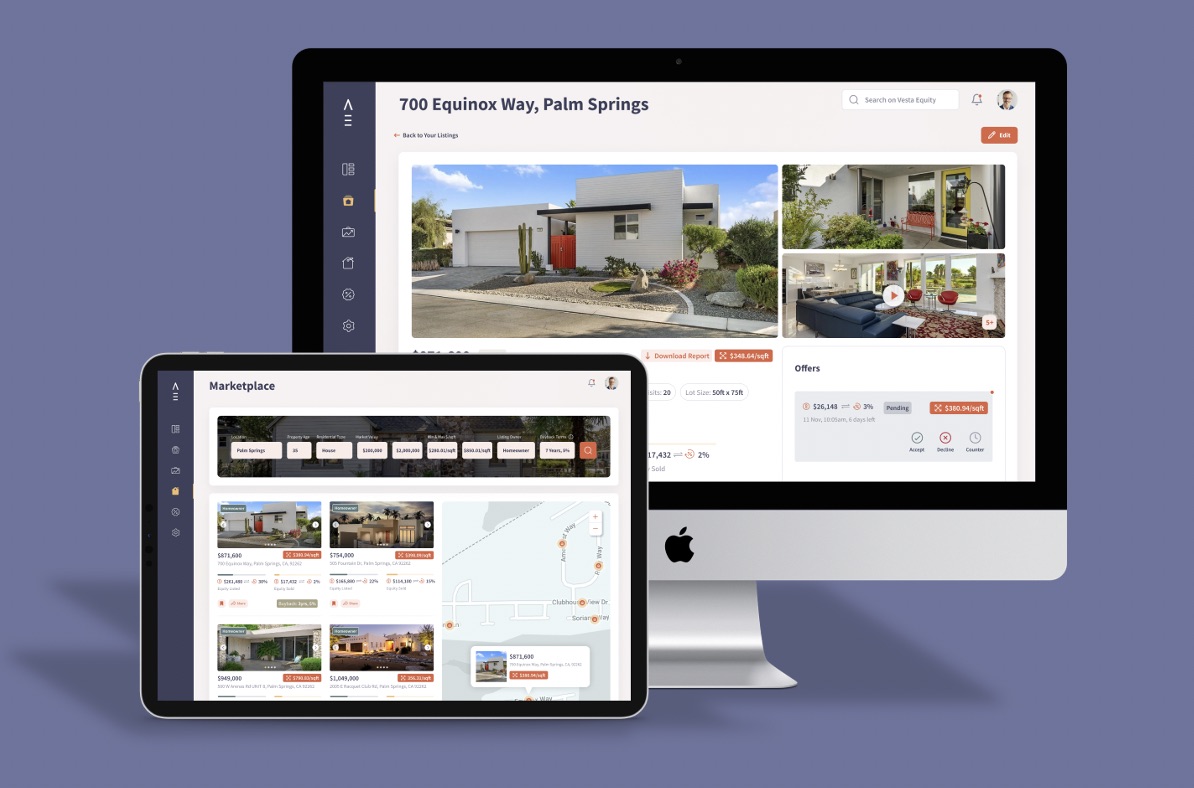

We have purpose-built a solution that enables you as an investor to build a portfolio of real estate assets the same way you would for a portfolio of stocks. We do this by enabling you to invest in properties where the owners have decided, through our platform, to tokenize a portion of their property equity and sell it to investors. They are doing this as an alternative to taking a loan from the bank and incurring debt with the associated costs and the heavy toll that compounding interest exacts on monthly payments. It allows them to access the value in the property and retain their residential rights. As an investor you get the opportunity to invest in an asset that appreciates in value with 100% transparency based on up-to-date inspections, photos, and updated property values. Plus, you have the assurance that someone is residing in the property, maintaining it, and paying the taxes and insurance. Our process is driven by the fractionalization of the property using tokens, smart contracts, the blockchain, property data, our marketplace, deeds of trust, and the automation of the legal elements. You can create a diverse portfolio based on geography, property type, and more. Through your dashboard you can track your investments, monitor your current offers, and track investment properties you have your eye on. Imagine owning percentages of properties in California, Texas, Florida, Illinois, and more. You can play some markets short where you feel appreciations are moving quickly or play them long where you feel there are solid year-over-year appreciations.

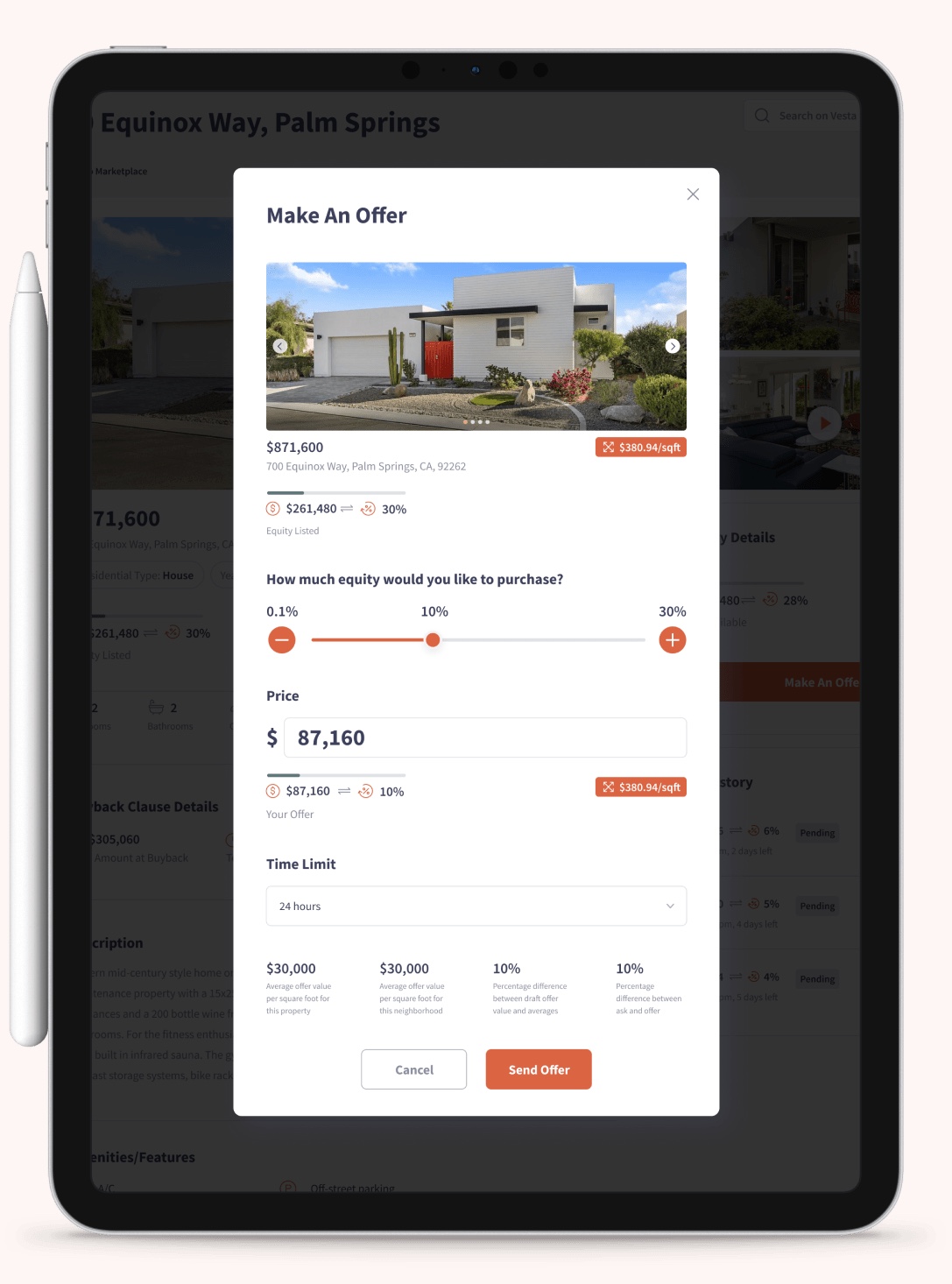

We have made it simple for you to onboard yourself and create an account. Within minutes you can be set up and viewing properties. When you want to invest, we have made it easy for you to transfer funds in and out of your wallet. When you see a property, you want to invest in, you simply decide how much of the owner’s offered equity you wish to purchase (i.e. 5% of the 40% offered on the marketplace) and with our buy/sell tools you make an offer to the property owner based on the appraised value, inspection, and other market data. They can accept, decline, or counter! When a deal is struck your percentage ownership represented by a token will appear in your wallet. Now that you have added your first property you can start building a diversified and growing portfolio of assets. No middlemen were involved, and you were able to maintain control over your wealth creation with 100% transparency.

You can even access the equity in your current property and diversify across multiple geographical areas. Why hold all your equity value in one place? You likely love your neighborhood and don’t want to move, but maybe property values are climbing higher in other counties and states driven by demographics and property supply. You can have the best of both worlds. Stay put and not move while benefiting from the diversification of your real estate asset.

In our next blog post, we will review market appreciations and trends and detail out the two types of properties you’ll see on our platform – residential and income properties. Look out for Part 2 of Building a Portfolio of Real Estate Tokens – Understanding the Market.

Vesta Equity is launching soon. To register as a property investor visit https://vestaequity.net/investors/ or alternatively as a homeowner looking to access your equity debt free https://vestaequity.net/homeowners/

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog