Latest Content > Building a Portfolio of Tokenized Real Estate – Understanding the Market

Building a Portfolio of Tokenized Real Estate – Understanding the Market

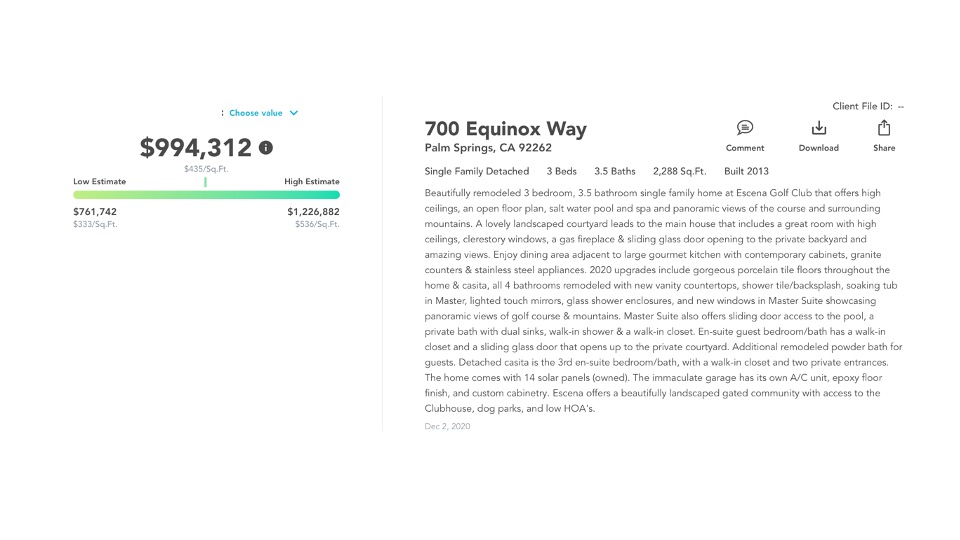

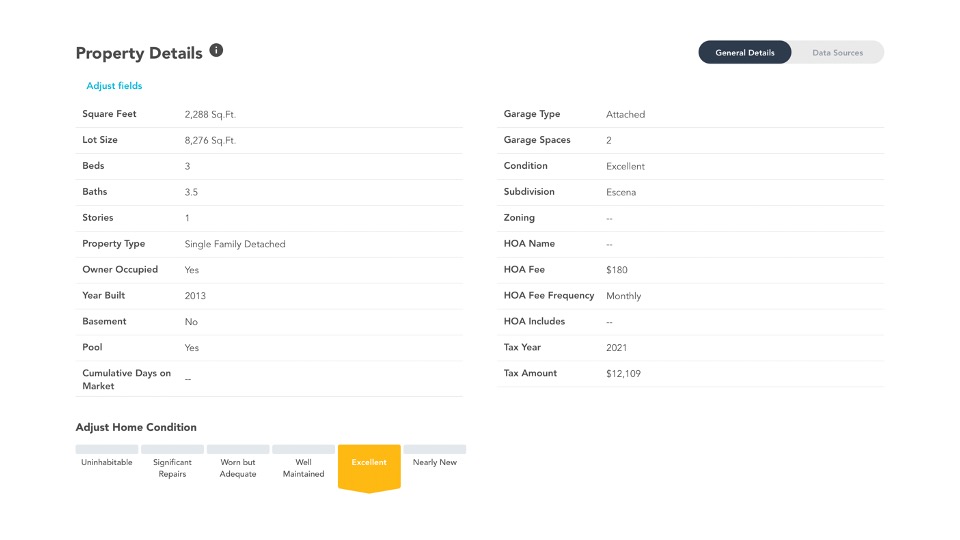

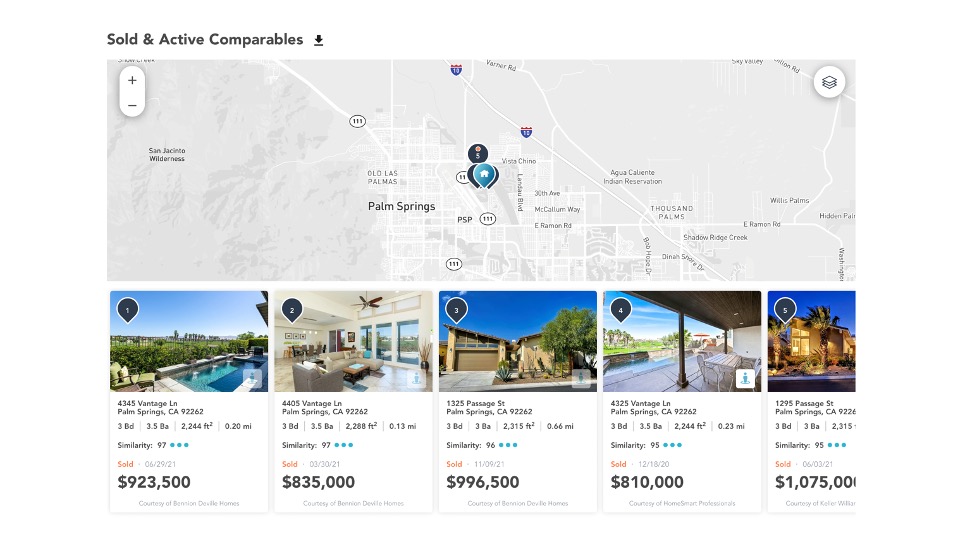

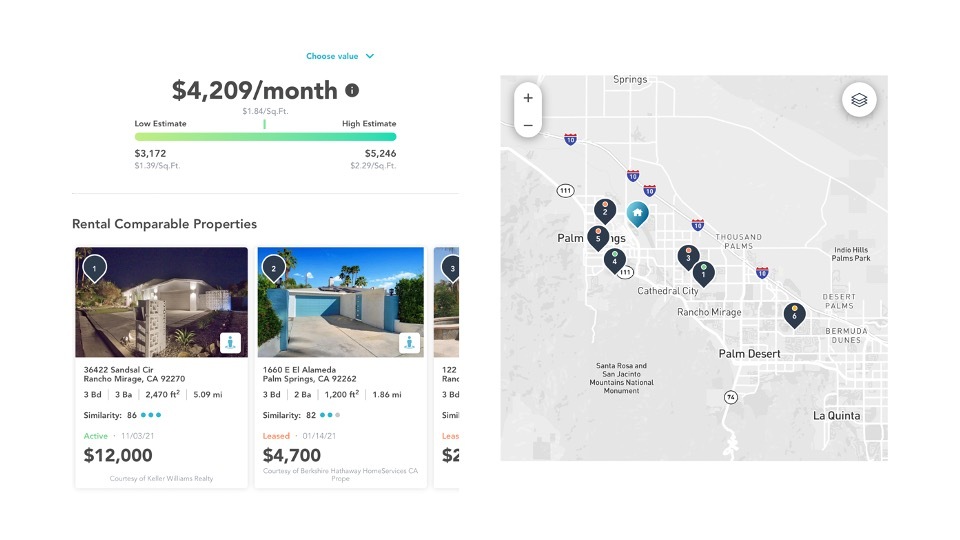

Imagine tapping into real market data that gives you a wealth of information on a property sales history over the last 15+ years, comparable sales of similar properties within the geographical area, projected rental values (even if the home is not an income property), home condition based on a recent inspection, and analysis on the probability of depreciation versus appreciation, with a 36-month market forecast for both.

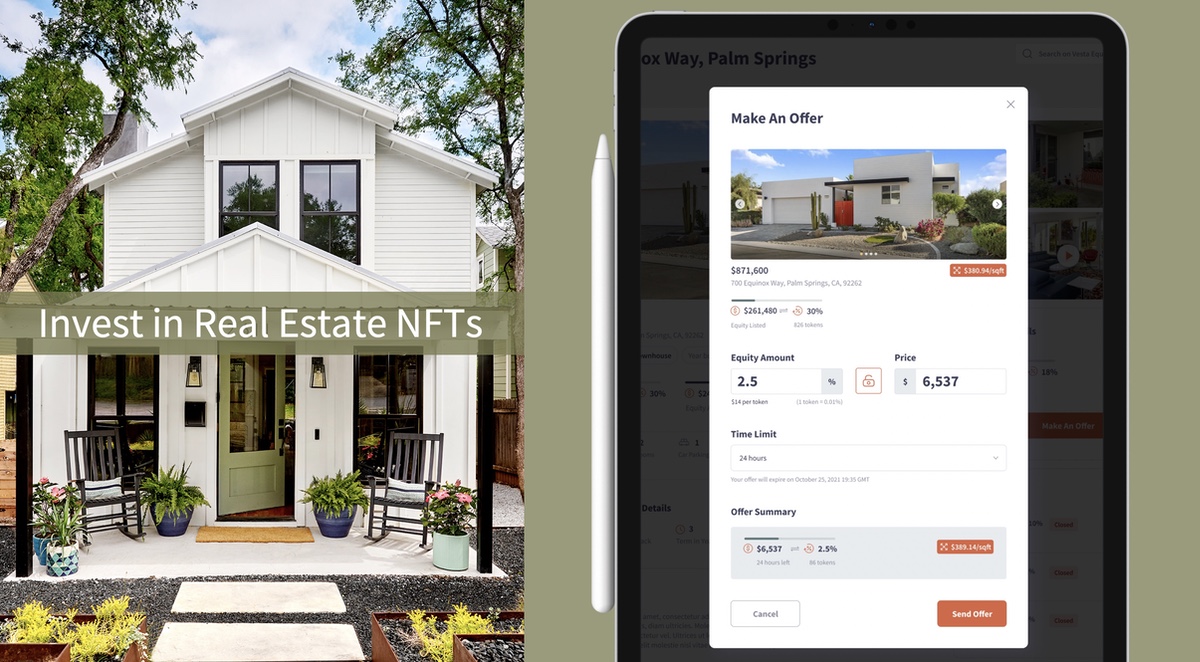

As an investor there are 2 types of properties that you are going to come across on Vesta Equity - residential and income properties. The two types are relatively self-explanatory. However, there are some differences that need to be considered when investing. With a residential property the homeowner remains in residence and does not derive any income off the property. You are purchasing a real estate-backed tokens with the goal of deriving a return on investment on the appreciation over time. With income properties they can range from a single owner managing the property to a business that owns and manages the unit. These units can be rented out as vacation rentals or as short to long term leases. The vacation rentals can be rented out through a myriad of options from Airbnb to VRBO to Booking.com to local rental agents. Depending on the market the rental income will understandably fluctuate based on seasonality. With income properties the owner offers a dividend attached to the token. The dividend terms (i.e., amount paid out, timing of dividend remission, and more) is set by the owner. Naturally, the dividend payout will factor in the owner’s related costs on the property. However, the dynamics of our marketplace means they will always have to factor in the competitiveness of their offer vis-à-vis what other income property owners are proposing. This is the nature of an open and transparent marketplace.

“But investing isn’t about beating others at their game. It’s about controlling yourself at your own game.” - Benjamin Graham

Your own investment thesis will drive your decision as to which path, you’ll chose. Income properties appreciate less than residential properties. However, with income properties you get some cash flow and under our model that cash flow comes with no sweat equity. Perhaps your investment thesis directs you to build your portfolio with a mix of both. The rule of thumb is the more cash flow focused you are, the less appreciation you get and vice versa. The beauty of our solution is the flexibility we offer so you can match your investment approach with both options on our platform.

While we always recommend doing your own homework before making investment decisions, we also want to provide you relevant data that can help you. There are a lot of factors that impact real estate prices, and some markets appreciate faster than others in the short term but might not perform as well over longer periods of time.

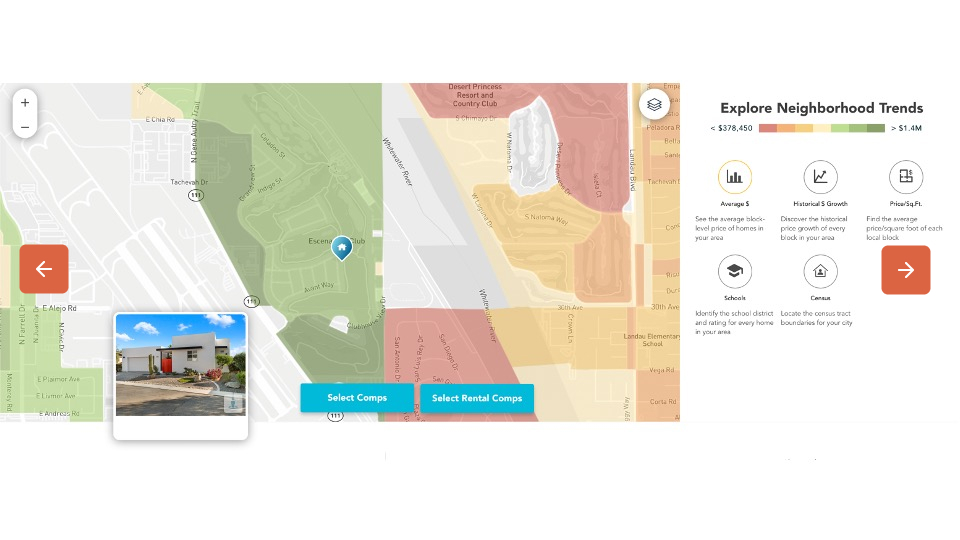

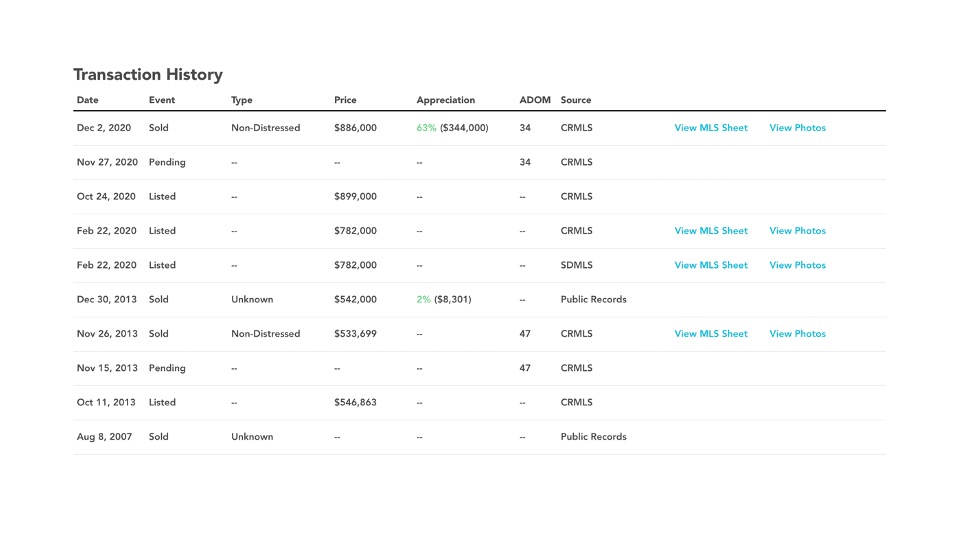

Our goal is to provide you information to make informed decisions and then deal directly with the asset holder. At the start, we provide a recent full home inspection and appraisal. We then provide you with detailed 3rd party market data. Click through these slides to see some of the data you’ll be able to use:

A great next step when making investment decisions is to draw up your own investment thesis. This means you’ll set goals, establish risk, define property types, allocations, target ROI, and more. While these can be flexible, they give you clear guides and a framework to buy and sell. Investment research always pays off. If you are looking to specific geographies read the local news, access local economic development plans, see what industries and service-based businesses are employing people in the area, what’s the local infrastructure like, how is the educational system, where is the area on its economic development curve, what is the demographic makeup, and more.

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog