Latest Content > Vesta Equity Market Recap 9.0

Vesta Equity Market Recap 9.0

For the most recent updates on the housing market, turn to Vesta Equity's Real Equity Marketplace Update 9.0. Please sign up to receive the recap weekly and share the recap with people in your network who want to stay on top of the latest housing trends and investment opportunities.

The Pulse on Housing

According to Freddie Mac, the number of single-family starter homes built in 2020 was just 20% of the number of those constructed annually throughout the 1970s and 1980s. As a result, the current nationwide housing deficit is estimated to be between 3.8 and 6.0 million units.

According to Freddie Mac, the number of single-family starter homes built in 2020 was just 20% of the number of those constructed annually throughout the 1970s and 1980s. As a result, the current nationwide housing deficit is estimated to be between 3.8 and 6.0 million units.

An analysis by Metlife investment management indicates that institutional investors may control 40% of U.S. single-family rental homes by 2030. This creates a backdrop for continued home price appreciation.

An analysis by Metlife investment management indicates that institutional investors may control 40% of U.S. single-family rental homes by 2030. This creates a backdrop for continued home price appreciation.

Despite a recent uptick in interest rate expectations, mortgage rates have seen little change. This reflects the fact that inflation is cooling and consumers have healthy balance sheets to finance home purchases.

Despite a recent uptick in interest rate expectations, mortgage rates have seen little change. This reflects the fact that inflation is cooling and consumers have healthy balance sheets to finance home purchases.

Top News in Housing

Real estate isn’t an alternative — it’s a core investment - In 2020, the global real estate market had a value of more than $326 trillion, which is more than the value of all the stocks and bonds in the world.

Real estate isn’t an alternative — it’s a core investment - In 2020, the global real estate market had a value of more than $326 trillion, which is more than the value of all the stocks and bonds in the world.

Pending home sales surge 8.1%, most since June 2020 - Healthy demand has returned to the housing market despite higher interest rates.

Pending home sales surge 8.1%, most since June 2020 - Healthy demand has returned to the housing market despite higher interest rates.

There's no easy way out of the structural housing shortage - Chronic underbuilding and land use restrictions have created a housing supply crisis in the US.

There's no easy way out of the structural housing shortage - Chronic underbuilding and land use restrictions have created a housing supply crisis in the US.

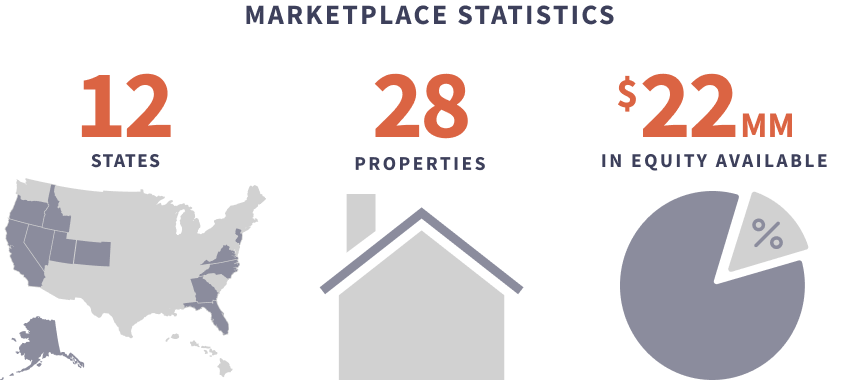

Vesta Equity Marketplace Overview

Looking for your next investment property? Easily invest in quality United States real estate - Buy shares, earn appreciation, and let the homeowners take care of the rest

Investment Properties

Resources to Learn More

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video