Latest Content > Vesta Equity Market Recap 5.0

Vesta Equity Market Recap 5.0

Vesta Equity brings you the Real Equity Marketplace Update 5.0 offering a concise view of the housing market. Stay up-to-date with the latest real estate news and market trends with this essential update. Please sign up to receive the recap weekly and share the recap with people in your network who want to stay on top of the latest housing trends and investment opportunities.

The Pulse on Housing

According to Freddie Mac, the recent decrease in mortgage rates could increase the buyer pool for a $400,000 loan by nearly 3 million consumers. This will help rejuvenate the US housing market.

According to Freddie Mac, the recent decrease in mortgage rates could increase the buyer pool for a $400,000 loan by nearly 3 million consumers. This will help rejuvenate the US housing market.

Despite the Fed’s hawkish tone last week, mortgage rates dropped when a 25 bp increase was announced. The market viewed this announcement favorably as it signalled that inflation is growing more slowly and the Fed is comfortable with the direction of the economy.

Despite the Fed’s hawkish tone last week, mortgage rates dropped when a 25 bp increase was announced. The market viewed this announcement favorably as it signalled that inflation is growing more slowly and the Fed is comfortable with the direction of the economy.

The US unemployment rate fell to the lowest level in 53 years. The Bureau of Labor Statistics reported that the unemployment rate dropped to 3.4%. The US economy added 517,000 jobs, which topped Wall Street estimates across the board.

The US unemployment rate fell to the lowest level in 53 years. The Bureau of Labor Statistics reported that the unemployment rate dropped to 3.4%. The US economy added 517,000 jobs, which topped Wall Street estimates across the board.

Top News in Housing

Blackrock inks partnership for asset tokenization - “Tokenization offers a variety of benefits, especially when it comes to transparency, as tokenized securities can be tracked and accounted for using the public blockchain ledger.”

Blackrock inks partnership for asset tokenization - “Tokenization offers a variety of benefits, especially when it comes to transparency, as tokenized securities can be tracked and accounted for using the public blockchain ledger.”

The pandemic is likely to have a structural, long-term impact on housing demand - This analysis highlights the fact that the surge in housing demand is indicative of a larger change in household behavior.

The pandemic is likely to have a structural, long-term impact on housing demand - This analysis highlights the fact that the surge in housing demand is indicative of a larger change in household behavior.

Mortgage rates are projected to drop - Lower mortgage rates are expected to entice first time buyers back to the market.

Mortgage rates are projected to drop - Lower mortgage rates are expected to entice first time buyers back to the market.

Even as interest rates rise, consumer credit remains resilient - Despite recent increases in interest rates, delinquencies remain well below historic averages which bodes well for the overall market.

Even as interest rates rise, consumer credit remains resilient - Despite recent increases in interest rates, delinquencies remain well below historic averages which bodes well for the overall market.

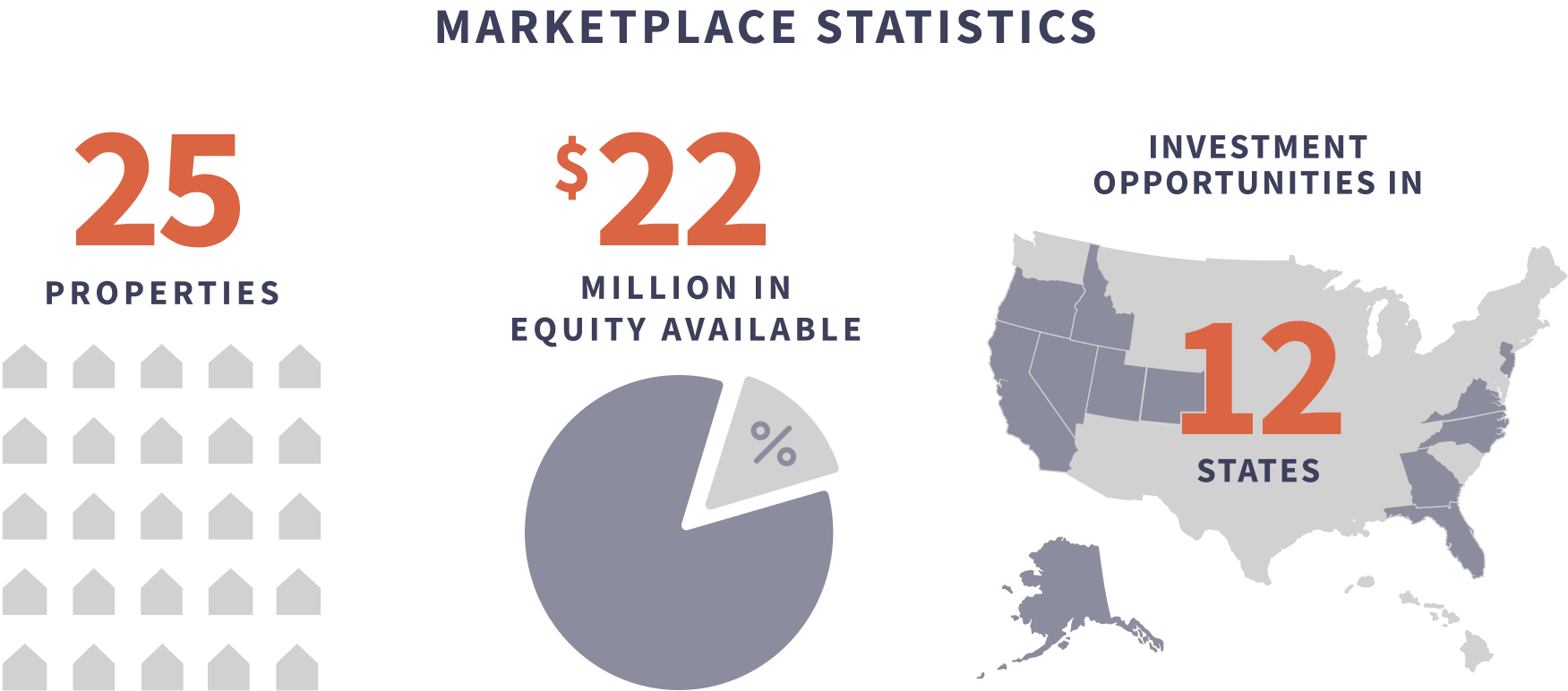

Vesta Equity Marketplace Overview

Looking for your next investment property? Easily invest in owner occupied real estate - Buy shares, earn appreciation, and let the homeowners take care of the rest

Investment Properties

Resources to Learn More

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video