Latest Content > Vesta Equity Market Recap 2.0

Vesta Equity Market Recap 2.0

Stay informed with the Real Equity Marketplace Update 2.0 brought to you by Vesta Equity. This week's article includes Vesta Equity's insights on the current housing market, as well as a recap of the top real estate stories. Please sign up to receive the recap weekly and share the recap with people in your network who want to stay on top of the latest housing trends and investment opportunities.

The Pulse on Housing

Existing home inventory declined month over month due to the fact that new listings have plummeted. Many homeowners are locked into low interest rates on their existing homes. As a result, many homeowners are not willing to list their properties. We expect that this trend will continue into 2023 and that homeowners will remain reluctant to sell their homes. As a result there will not be a material increase in existing home inventory. Existing inventory remains well below pre-pandemic levels.

Existing home inventory declined month over month due to the fact that new listings have plummeted. Many homeowners are locked into low interest rates on their existing homes. As a result, many homeowners are not willing to list their properties. We expect that this trend will continue into 2023 and that homeowners will remain reluctant to sell their homes. As a result there will not be a material increase in existing home inventory. Existing inventory remains well below pre-pandemic levels.

Last week, mortgage rates fell to the lowest level since September. As a result, there has been a slight uptick in purchasing activity and refinance activity. This reflects the fact that the housing market is normalizing and buyers are returning to the market despite recent volatility. Numerous realtors are reporting that open house activity has picked up significantly relative to October.

Last week, mortgage rates fell to the lowest level since September. As a result, there has been a slight uptick in purchasing activity and refinance activity. This reflects the fact that the housing market is normalizing and buyers are returning to the market despite recent volatility. Numerous realtors are reporting that open house activity has picked up significantly relative to October.

Despite several rate hikes throughout the second half of 2022, the US labor market finished the year red hot. However, other measures of economic health such as employee wage growth and the ISM services index have shown weakness in recent weeks. Some of the weakening macro signals are prompting investors to question how many more rate increases the Fed will implement in 2023 in order to tame inflation.

Despite several rate hikes throughout the second half of 2022, the US labor market finished the year red hot. However, other measures of economic health such as employee wage growth and the ISM services index have shown weakness in recent weeks. Some of the weakening macro signals are prompting investors to question how many more rate increases the Fed will implement in 2023 in order to tame inflation.

Top News in Housing

Median home prices showed year-over-year growth for the 130th month in a row - The median existing-home price for all housing types was 2.3% higher in December 2022 than December 2021. This marks 130 consecutive months of year-over-year increases, the longest-running streak on record.

Median home prices showed year-over-year growth for the 130th month in a row - The median existing-home price for all housing types was 2.3% higher in December 2022 than December 2021. This marks 130 consecutive months of year-over-year increases, the longest-running streak on record.

What to expect from homebuilders in 2023 - Builders expect to see friction in certain areas of the supply chain subside, labor to remain tight, and levels of demand varied across the county.

What to expect from homebuilders in 2023 - Builders expect to see friction in certain areas of the supply chain subside, labor to remain tight, and levels of demand varied across the county.

Mortgage interest rates expected to drop in 2023 -Mortgage rates have been on a downward trend since September 2022. Vesta Equity believes that the market is normalizing and homebuyers will rush back to the market in 2023.

Mortgage interest rates expected to drop in 2023 -Mortgage rates have been on a downward trend since September 2022. Vesta Equity believes that the market is normalizing and homebuyers will rush back to the market in 2023.

The Southeast and Texas were Uhaul’s top one-way destinations in 2022 - Low interest rates, low cost of living, and favorable business environments have driven migration to the sunbelt states. With interest rates higher, will the pace of migration slow in 2023?

The Southeast and Texas were Uhaul’s top one-way destinations in 2022 - Low interest rates, low cost of living, and favorable business environments have driven migration to the sunbelt states. With interest rates higher, will the pace of migration slow in 2023?

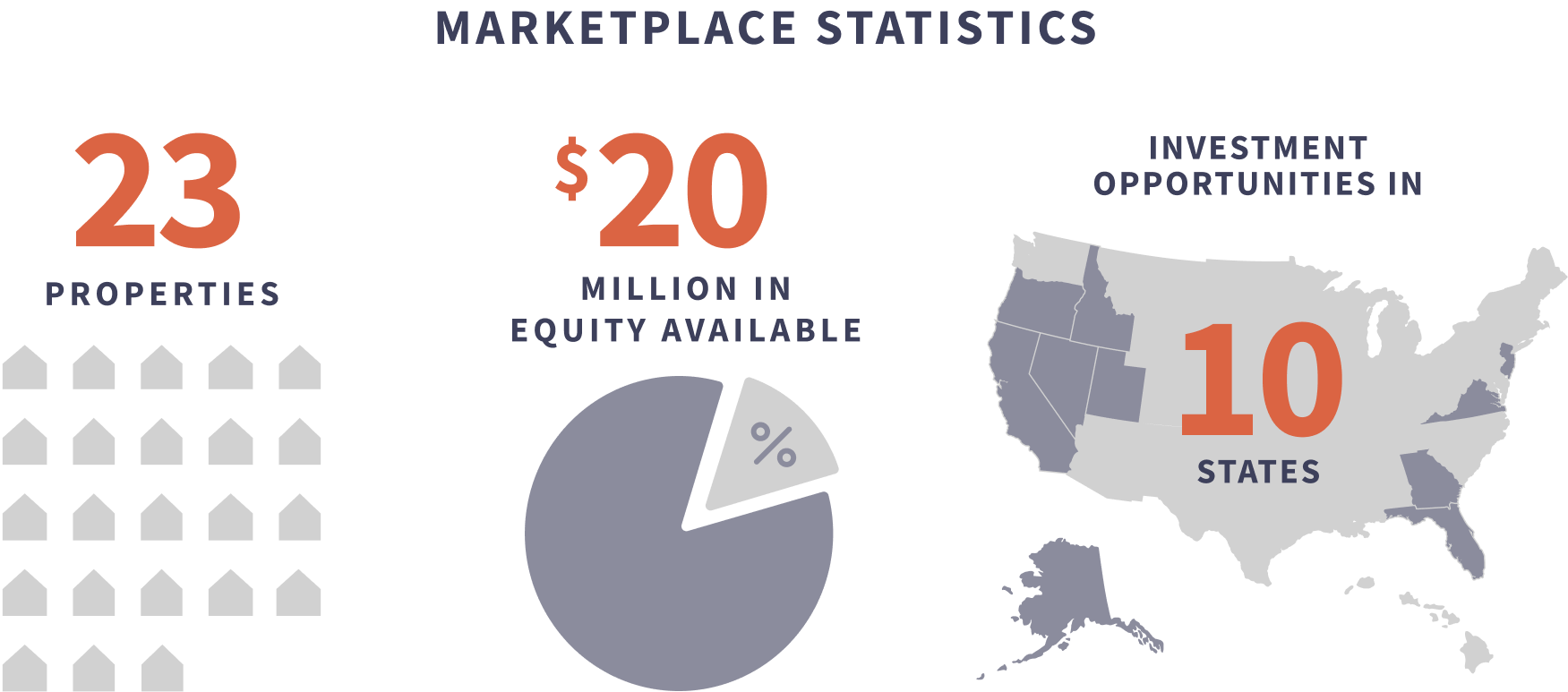

Vesta Equity Marketplace Overview

Looking for your next investment property? Easily invest in owner occupied real estate - Buy shares, earn appreciation, and let the homeowners take care of the rest

Investment Properties

Resources to Learn More

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video