Latest Content > Vesta Equity Market Recap 13.0

Vesta Equity Market Recap 13.0

Keep your finger on the pulse of the market with Vesta Equity's Real Equity Marketplace Update 13.0 edition. Please sign up to receive the recap weekly and share the recap with people in your network who want to stay on top of the latest housing trends and investment opportunities.

The Pulse on Housing

Home Prices Show Resilience as 7-Month Slide Comes to an End - The latest Black Knight Mortgage Monitor report suggests a healthy housing market, with low and stable mortgage delinquencies.

Home Prices Show Resilience as 7-Month Slide Comes to an End - The latest Black Knight Mortgage Monitor report suggests a healthy housing market, with low and stable mortgage delinquencies.

Mortgage Delinquencies in the U.S. Remain Near Record Lows, Latest Data Show.

Mortgage Delinquencies in the U.S. Remain Near Record Lows, Latest Data Show.

Construction Spending Remains Stable, But Residential Category Still Struggling.

Construction Spending Remains Stable, But Residential Category Still Struggling.

Investment Properties

Top News in Housing

43% surge in rate lock volume indicates a rate-sensitive market - The article reports a significant increase in rate lock volume, which suggests that the housing market is highly sensitive to interest rates. The rise in rate lock volume is a result of borrowers wanting to secure low mortgage rates, and the trend is expected to persist.

43% surge in rate lock volume indicates a rate-sensitive market - The article reports a significant increase in rate lock volume, which suggests that the housing market is highly sensitive to interest rates. The rise in rate lock volume is a result of borrowers wanting to secure low mortgage rates, and the trend is expected to persist.

The Predicted $1 Trillion Plunge Did Not Materialize - While 2023 is expected to show a slight dip in home prices, the following years are predicted to see an increase in home values, and even the optimistic quartile of experts predict aggregate U.S. home values to grow to $60.9 trillion by the end of 2027.

The Predicted $1 Trillion Plunge Did Not Materialize - While 2023 is expected to show a slight dip in home prices, the following years are predicted to see an increase in home values, and even the optimistic quartile of experts predict aggregate U.S. home values to grow to $60.9 trillion by the end of 2027.

Mortgage Rates Show Volatility, Bouncing Back After Hitting Two-Month Lows - Mortgage rates have rebounded after hitting two-month lows, indicating volatility in the market. This suggests that there are factors at play that are causing fluctuations in interest rates, which could potentially impact the housing market.

Mortgage Rates Show Volatility, Bouncing Back After Hitting Two-Month Lows - Mortgage rates have rebounded after hitting two-month lows, indicating volatility in the market. This suggests that there are factors at play that are causing fluctuations in interest rates, which could potentially impact the housing market.

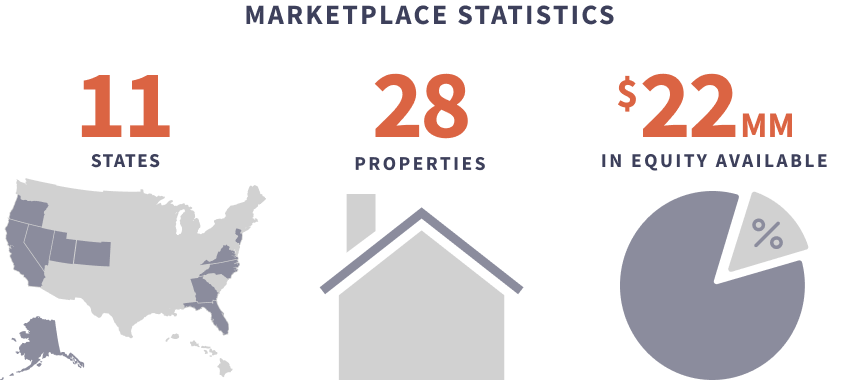

Vesta Equity Marketplace Overview

Looking for your next investment property? Easily invest in quality United States real estate - Buy shares, earn appreciation, and let the homeowners take care of the rest.

Resources to Learn More

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video