Latest Content > Vesta Equity Market Recap 10.0

Vesta Equity Market Recap 10.0

For the latest information on the housing market, consult Vesta Equity's Real Equity Marketplace Update 10. Please sign up to receive the recap weekly and share the recap with people in your network who want to stay on top of the latest housing trends and investment opportunities.

The Pulse on Housing

A report by CoreLogic found that Home equity continued to grow during the fourth quarter of 2022. By the end of December, 63% of homeowners saw equity increase by 7.3% for a collective gain of $1 trillion. Tappable home equity nationwide exceeded $10 trillion at year end 2022.

A report by CoreLogic found that Home equity continued to grow during the fourth quarter of 2022. By the end of December, 63% of homeowners saw equity increase by 7.3% for a collective gain of $1 trillion. Tappable home equity nationwide exceeded $10 trillion at year end 2022.

According to a recent housing study “The number of cost-burdened renters who pay more than 30 percent of their incomes on rent hit a 20-year high of 21.6 million households in 2021. This was a 1.2 million household increase over the 2019 pre-pandemic level and included a record 11.6 million households who were paying more than 50 percent of their incomes on housing.” Vesta Equity’s innovative home equity financing solution is needed to increase affordability for consumers.

According to a recent housing study “The number of cost-burdened renters who pay more than 30 percent of their incomes on rent hit a 20-year high of 21.6 million households in 2021. This was a 1.2 million household increase over the 2019 pre-pandemic level and included a record 11.6 million households who were paying more than 50 percent of their incomes on housing.” Vesta Equity’s innovative home equity financing solution is needed to increase affordability for consumers.

Stubborn inflation and high interest rates continue to cause fallout in the mortgage market while home equity remains a bright spot within the housing sector. Equity sharing agreements have taken center stage as the newest financial innovation.

Stubborn inflation and high interest rates continue to cause fallout in the mortgage market while home equity remains a bright spot within the housing sector. Equity sharing agreements have taken center stage as the newest financial innovation.

Top News in Housing

Home equity is the bright spot of the housing market - Vesta Equity is proud to be mentioned as a portfolio company of Redwood Trust (NYSE: RWT).

Home equity is the bright spot of the housing market - Vesta Equity is proud to be mentioned as a portfolio company of Redwood Trust (NYSE: RWT).

After big bank failure, renewed questions about Home Loan Bank System - New innovations are needed to drive the home financing market forward. Innovators are looking to equity sharing agreements.

After big bank failure, renewed questions about Home Loan Bank System - New innovations are needed to drive the home financing market forward. Innovators are looking to equity sharing agreements.

Monthly home payments soar - The typical homebuyer's monthly payment is $2,563 this week, up 29% from the same time last year.

Monthly home payments soar - The typical homebuyer's monthly payment is $2,563 this week, up 29% from the same time last year.

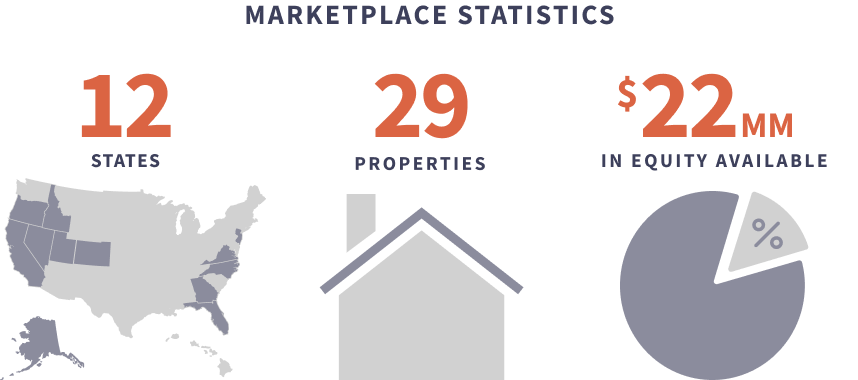

Vesta Equity Marketplace Overview

Looking for your next investment property? Easily invest in quality United States real estate. Buy shares, earn appreciation, and let the homeowners take care of the rest.

Investment Properties

Resources to Learn More

Sign up to get alerts about new posts

What’s New

Is A Tokenized Real Estate Asset Really a Security?

In recent years, the real estate market has seen a significant transformation with the advent of tokenization, a process where real estate assets are converted into digital tokens on a blockchain. This innovation promises increased access, liquidity, and streamlined transactions, marking a shift in how we perceive and leverage real estate and investments.

Read Blog

Read Blog

Short Cuts: Expert Insights from the Pros on Real Estate Ownership and Investing with Blockchain

Within Blockchain, numerous fundamental principles are in place to ensure transparency and combat fraud. They commence with the transactions themselves, which are both verifiable and permanent, taking place between two parties within a decentralized network.

Watch Video

Watch Video