Latest Content > Accessing Your Real Estate Wealth - Getting Started

Accessing Your Real Estate Wealth - Getting Started

When we think about the services that impact our lives on a daily basis we increasingly prioritize flexibility and convenience. Remote work has become a criteria in the job market, and with different varieties that cater to how often we want to be in the office. Ride-sharing gives us on-demand and frictionless mobility. Food apps, streaming video, and the list goes on.

At Vesta Equity we spoke to hundreds of homeowners who unfortunately have not had many of these benefits when accessing money tucked away in their home equity. The same dilemma popped up over and over: hard-working and responsible homeowners paying down their mortgages only to need their money later and having to borrow it (repeat, borrow their own money). With interest and, of course, too much fine print.

“Borrowing is the most expensive form of financing” - Anonymous

This presents a clear problem that we solve with our platform. Fundamentally, we believe that average real estate property owners, whether for their primary residence or their income properties, should have a debt-free way to access the money tied up in their equity in a flexible and convenient way. All while retaining full residential rights to their properties.

Vesta Equity’s marketplace allows property owners (current and prospective) to fractionalize and sell home equity directly to property investors rather than borrow. In investment terms, this equity would otherwise be illiquid which is a technical way of saying that it’s hard to convert into cash. Our platform enables a property owner to easily divide the equity into small units, place them for sale on a marketplace, and confidently take a hands-off approach to the necessary legal work to make the transaction compliant because this is all built into the solution.

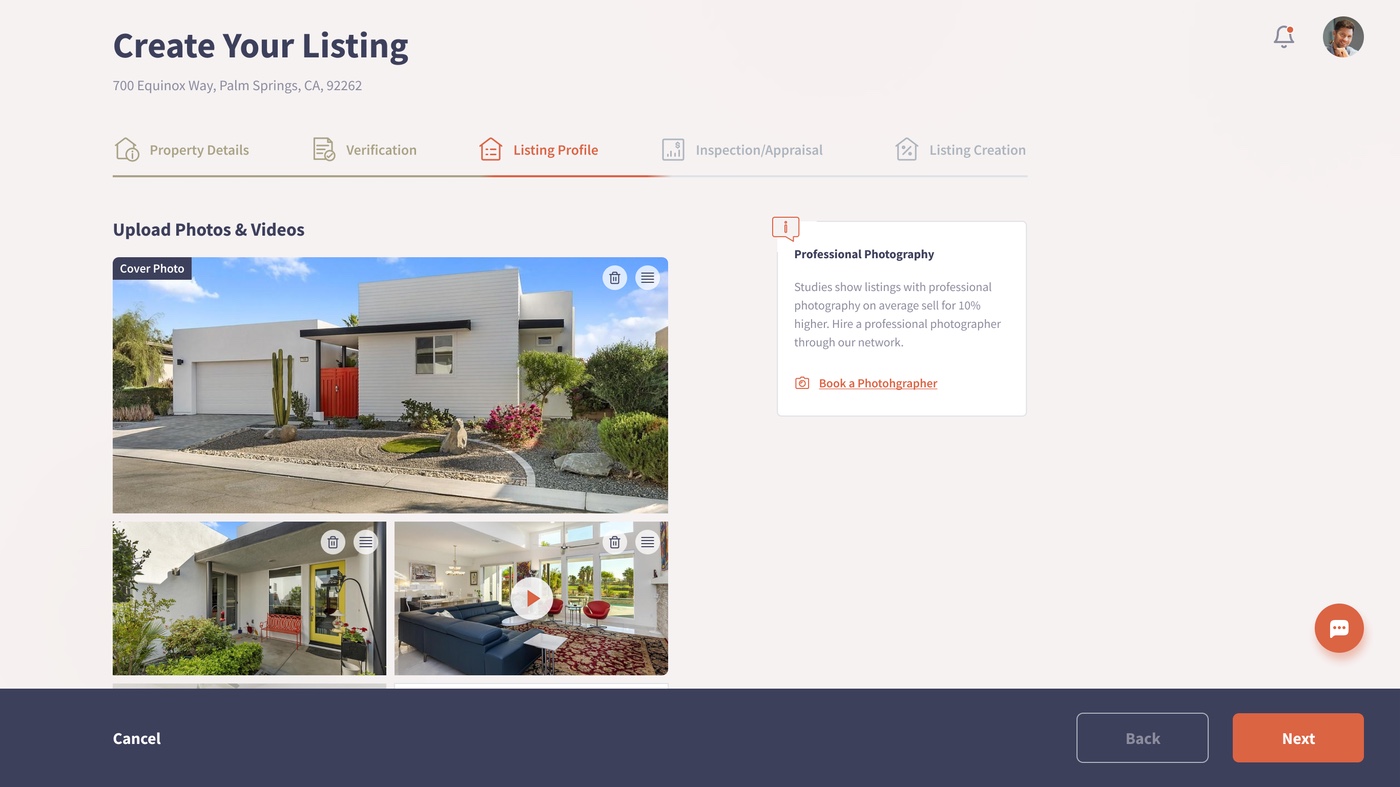

Account creation on the platform leads to a guided application process which first reviews some basic personal information needed to verify the property owner’s identity and then looks at the property’s eligibility - details such as how much equity is available. If these criteria are met, the next stage is an abbreviated closing process that includes a formal inspection and professional photography to show off the property. These services are all booked seamlessly through the platform. The result is a contractual partnership between the property owner and Vesta Equity. This allows the owner to sell their equity by using the platform’s tools in exchange for a service fee at the point of transaction. The contract also creates a legal interest in the property for Vesta Equity that is conferred to investors who buy into the property, essentially making sure that the investor has legal rights to the asset they’ve purchased, but with full residential rights remaining with the homeowner.

Once onboarded, the property owner then creates a listing for potential buyers. Homeowners, who visit MLS real estate websites and know how to use basic online banking will find our solution very familiar and easy to use. When creating a listing all of the property specs, photos, and market value are automatically populated. The property owner can add a custom description and then set the appropriate deal terms for the listing. For example, how much equity do they want to offer and at what price?

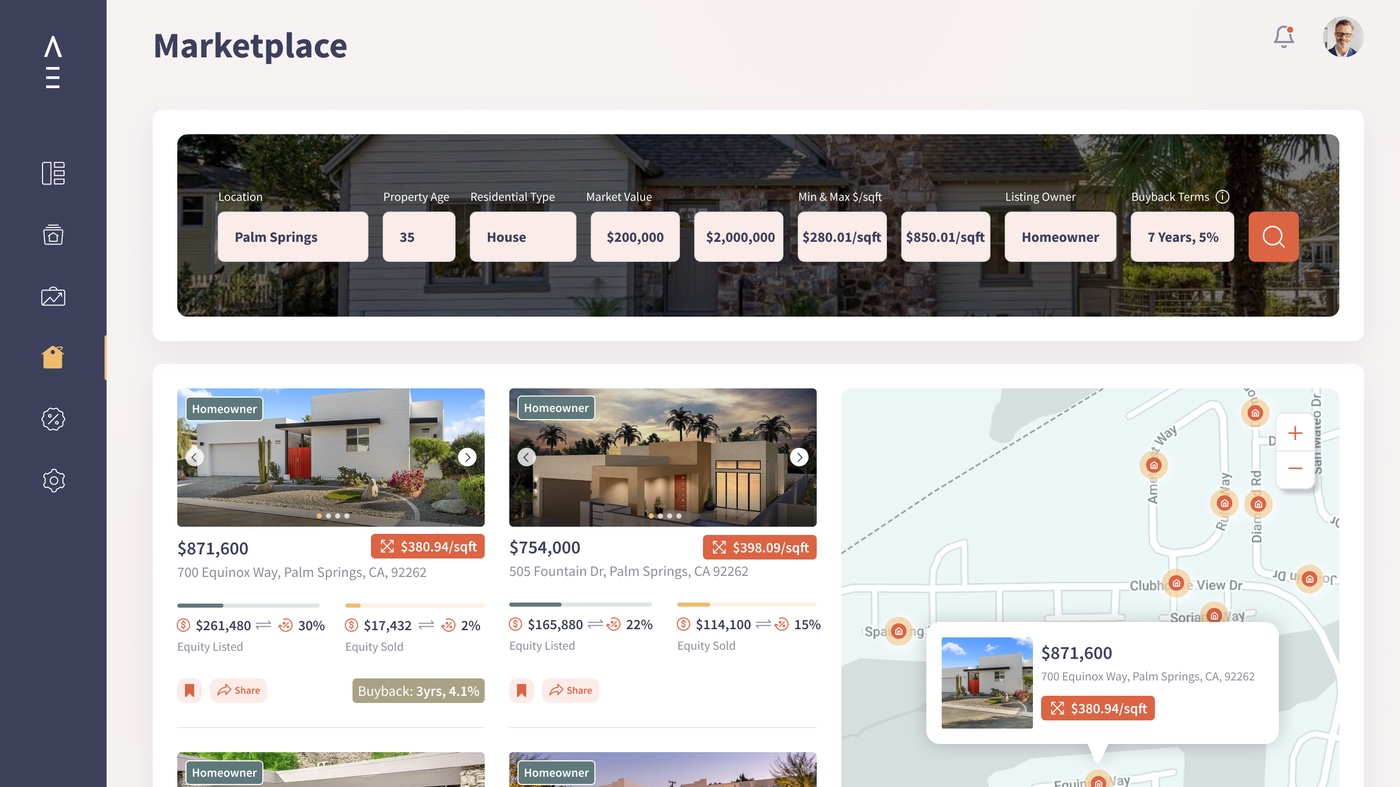

The property owner then publishes the listing, and it becomes available to be searched on the marketplace. Property investors might search by region, property value, equity price, and more depending on what kinds of assets they want to hold. They may, for example, want exposure to a few particular markets that are appreciating well but don’t have the means or investment thesis to buy whole investment property in those markets. They could also want property-level transparency that packaged real estate funds don’t offer. For these investors, Vesta Equity provides direct investment access to an asset class they would otherwise not easily be able to access.

In the next part of this series we’ll dive into the deal aspects of the transaction from the perspective of the property owner when a buyer decides to make an offer on the listing.

Vesta Equity is launching soon. To register as a property investor visit https://vestaequity.net/investors/ or alternatively as a homeowner looking to access your equity debt free https://vestaequity.net/homeowners/

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog