Latest Content > The Inequity of Borrowing Money

The Inequity of Borrowing Money

Borrowing comes with high costs and lots of risks. Take a look at the average credit card interest or your average mortgage and see how much money the bank is making off the loan. With home equity loans like mortgages, the bank also ensures all rights are in its favour, and the risk of foreclosure or penalties are omnipresent throughout the term of the loan.

The typical monthly mortgage payment in the US ranges from $1,275 to $1,751, depending on the term. This sounds reasonable when you look at it from a cash flow perspective vis-a-vis your monthly income. However, when you break this monthly number down into paying off the debt versus the loan interest, you begin to see the massive inequities built into the system favouring the financial institutions.

Let's assume you buy a $300,000 home today, and you have saved up for a 20% deposit. That means you'll need a loan amount of $240,000. You decide on a bank and get approved. It is for a 30-year term, and in this example, let's assume an average interest of 2.86%. That will be 360 payments until 2051 for a total of $357,774.74. Meaning you just helped the bank get rich with your interest payments of $111,774,74. To borrow $240,000, you paid the bank a vast sum equivalent to 46% of the money you needed. That's the hidden impact of compounding interest.

“We tend to compartmentalize our debt: categorizing our mortgage debt as one kind of debt, installment loans as another, and credit cards as still another. Most treat all person (consumer) debt separately from mortgage debt. The fact is that debt is debt. All of it is owed and has to be paid back!” - Dale Vermillion, Author

Fast forward to the point where you have paid off your house, and you need access to the cash! Perhaps you want to start a home-based business, or your child has gotten into medical school. The good news is that throughout ownership, your home has appreciated. It is now worth $654,000. The bad news is that you have two only two options to access your hard-earned equity. Sell and pay a realtor a hefty commission, incur closing costs, find a new place to live, pay for moving expenses, and more. The other path takes you right back to the steps of the bank you just paid a $111,774.74 interest to over 30 years. Essentially, you start a similar cycle all over again. When is your money actually your money?

For centuries now, residential property has been viewed through an antiquated analog lens. It is indivisible and can not be financed in any other way than to borrow. Your only source for this is the behemoth financial institutions with their lofty headquarter towers dominating the city skylines. However, that's no longer the case. Technology has provided a new path. One that is fairer and removes the need for loans and those killer monthly payments that keep you handcuffed to a paradigm that no longer works.

Your home can now be treated as a digital asset and divided. The intersection of the internet and blockchain technology has enabled an entirely new methodology for conducting commerce, one that removes the need for traditional institutions and creates a frictionless, transparent, secure and immutable solution for parties to transact. The value of your home can now be tokenized and digitally divided. Meaning you can sell a portion of your home while keeping full residential rights in return for that investor benefiting from the asset's future appreciation. You no longer need a loan and have to deal with compounding interest with bank fees.

Sound fantastical? It is not, and blockchain is currently being used in a broad scope of industries to facilitate the transfer of money globally, manage global supply chain and logistics, verify products' provenance to stop fraud, optimize manufacturing, and much more. Vesta Equity has built and developed a solution that will enable you to do what we have just described. Access your cash on your terms unencumbered by the lopsided rules of financial institutions.

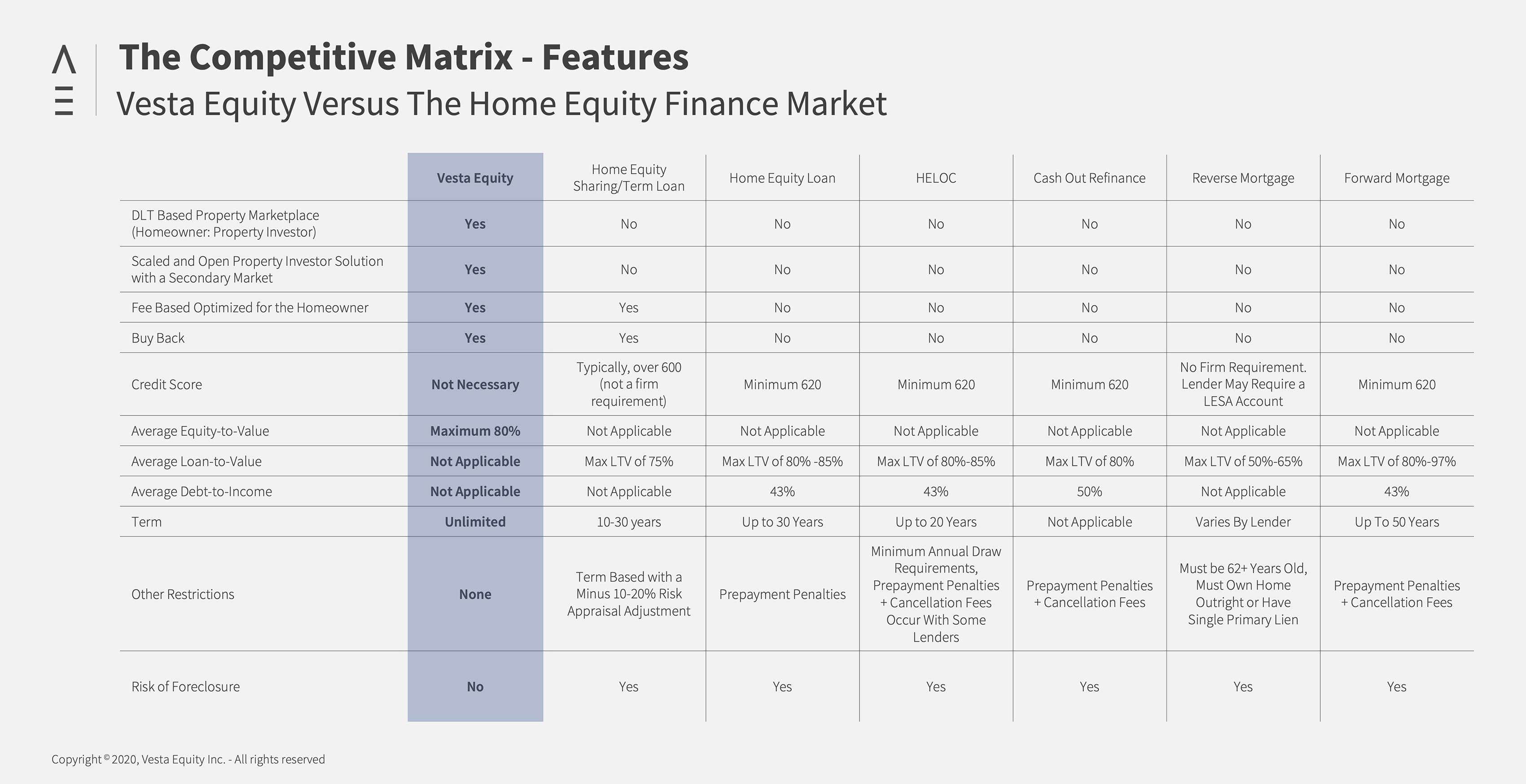

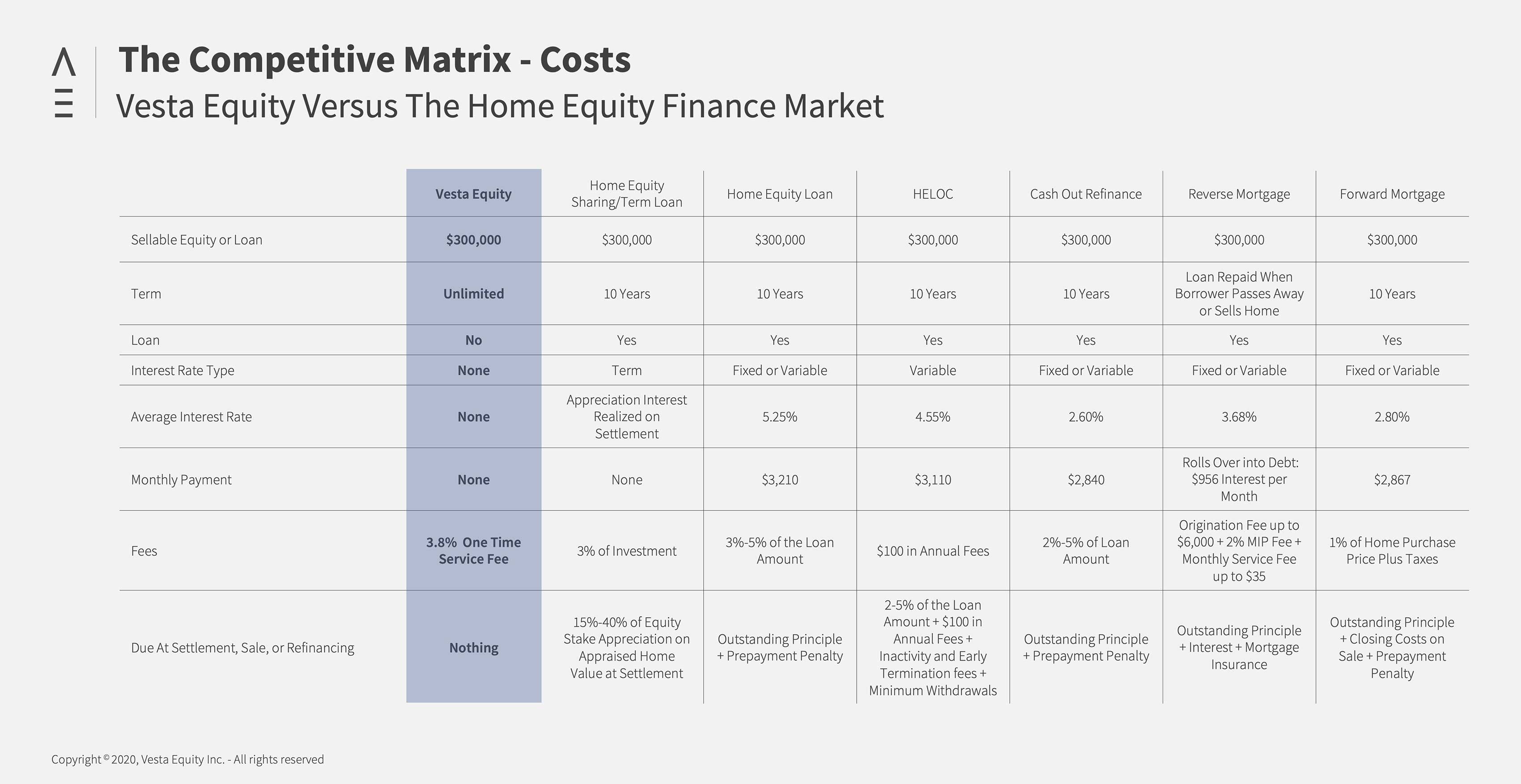

For an in-depth look at the differences for financing your home between traditional options and our equitable approach, check out these two comparison charts:

The evolutions in Fintech will usher in a new era in capitalism and bring more balance to a wide range of financial transactions, making it easier for you to access your wealth and use it to build a better future and live in prosperity.

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog