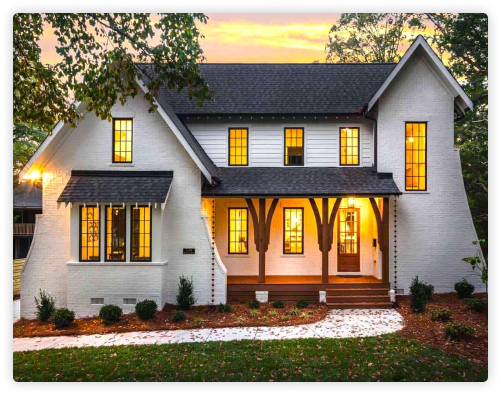

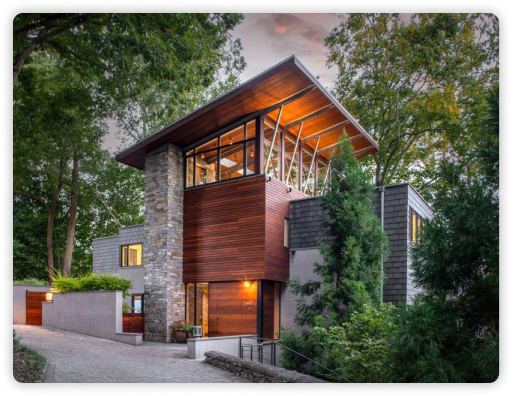

Seamlessly tap into a wealth of residential properties and invest by neighborhoods, property types, appreciation, and more.

The Transaction Basics

Vesta Equity's solution allows homeowners to sell equity to property investors through an equity sharing structure that ensures the homeowner retains full residential rights with no term length. In exchange for funds from property investors, a homeowner sells the financial rights to a percentage of their property's equity and future value. The home equity is realized when the property is sold.

Example: A homeowner with a property valued at $500K sells 20% of their equity on Vesta Equity and receives $100K from property investors. Later on, the homeowner sells the property itself for $600K to a new buyer and repays the investors of $120K from the proceeds of the sale.

Account Setup & Eligibility

Accredited investors in the US can participate while non-US investors don't require accreditation.

Accredited investors in the US can participate while non-US investors don't require accreditation.

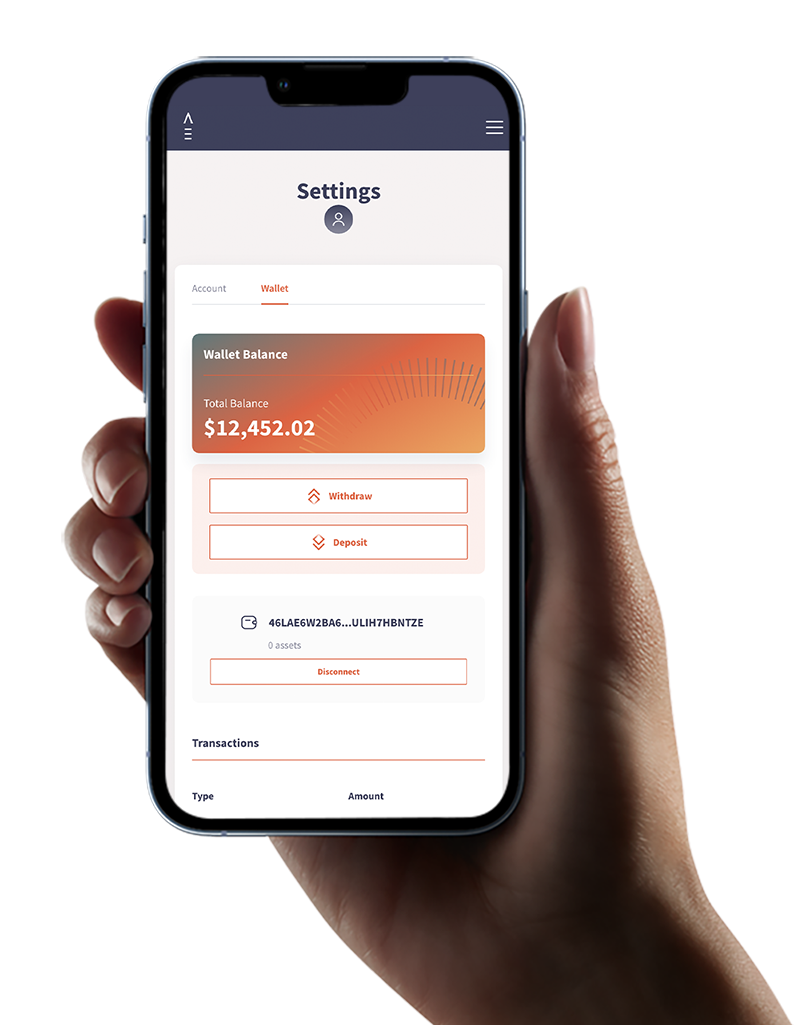

Investors can create their own secure wallet in a guided process on Vesta Equity. Funding a wallet can be made by sending a wire transfer from a linked bank account or by transferring USDC into the wallet.

Investors can create their own secure wallet in a guided process on Vesta Equity. Funding a wallet can be made by sending a wire transfer from a linked bank account or by transferring USDC into the wallet.

All users are required to undertake a simple industry standard Digital ID and KYC/AML process prior to opening an account.

All users are required to undertake a simple industry standard Digital ID and KYC/AML process prior to opening an account.

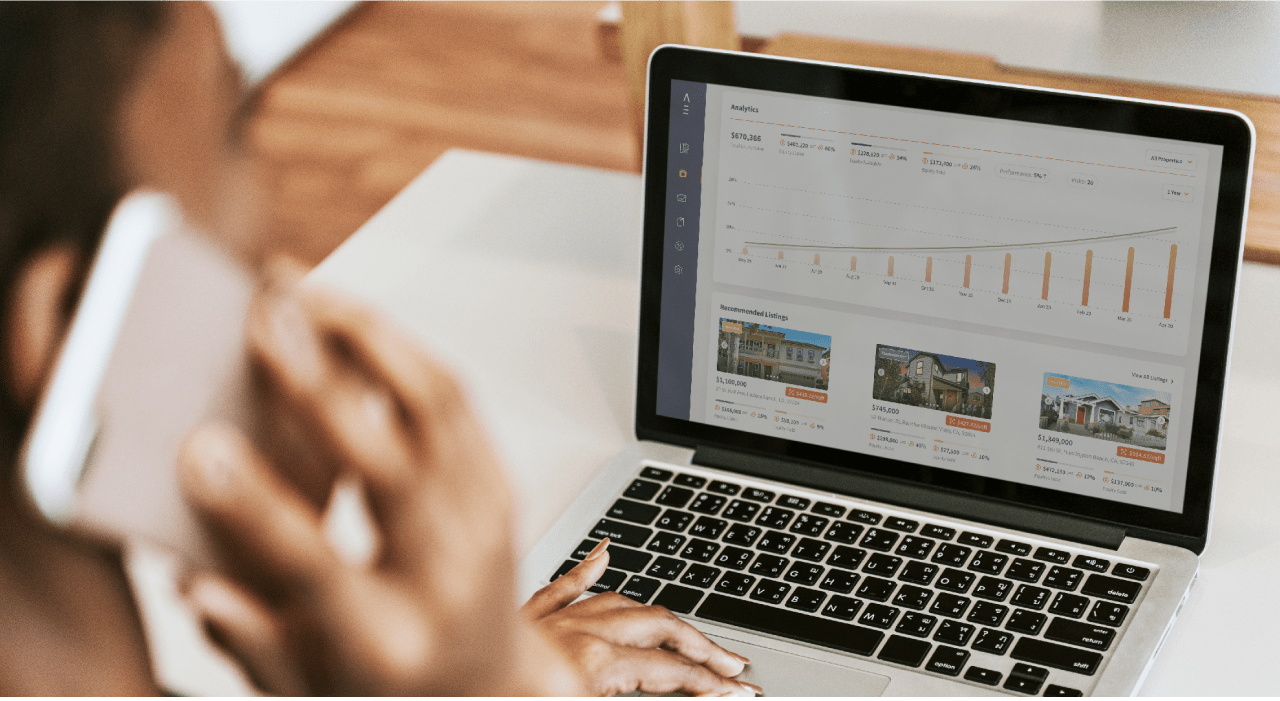

Our Zip-Code-Level forecast shows how this home is likely to appreciate in the next 36 months based on rate of home price growth in the Zip-Code.

Transaction Structure and Securities Offering

Every property is contracted using an Equity Sharing Agreement (ESA) and a security instrument that becomes recorded in the property's county. A property-specific, Investor LLC entity is formed to hold these real estate contract assets.

Every property is contracted using an Equity Sharing Agreement (ESA) and a security instrument that becomes recorded in the property's county. A property-specific, Investor LLC entity is formed to hold these real estate contract assets.

Each token represents a 0.01% membership in the Investor LLC. This membership interest has an equivalence to the equity sold by the homeowner.

Each token represents a 0.01% membership in the Investor LLC. This membership interest has an equivalence to the equity sold by the homeowner.

Example: by purchasing 20% of a property on a property listing, an investor receives 2,000 membership units in the Investor LLC specific to that property.

Example: by purchasing 20% of a property on a property listing, an investor receives 2,000 membership units in the Investor LLC specific to that property.

Listings are compliant with US securities laws with offering documentation available on each listing.

Listings are compliant with US securities laws with offering documentation available on each listing.

Searching the Marketplace

and Making Offers

Investors can browse for listings with properties that are assets they want to hold in their portfolios. Listings have updated valuation data along with projected 3-year forecasts and historical neighborhood data to provide investors with an estimate for the asset's growth.

Investors can browse for listings with properties that are assets they want to hold in their portfolios. Listings have updated valuation data along with projected 3-year forecasts and historical neighborhood data to provide investors with an estimate for the asset's growth.

Investors can place offers on any listing for as little as 0.01% of the equity and any dollar amount.

Investors can place offers on any listing for as little as 0.01% of the equity and any dollar amount.

Homeowners can accept or reject offers as well as make counter-offers.

Homeowners can accept or reject offers as well as make counter-offers.

Once both parties accept an offer, transactions are settled immediately with investors signing the subscription agreement and receiving the tokenized asset in their wallet.

Once both parties accept an offer, transactions are settled immediately with investors signing the subscription agreement and receiving the tokenized asset in their wallet.

Investors Can Receive

Liquidity From a Number

of Events

Relisting the token on Vesta Equity’s secondary market (available in early 2023).

Relisting the token on Vesta Equity’s secondary market (available in early 2023).

The homeowner exercises an early buyout within 3 years at the higher of either a minimum 10% annual appreciation or market value.

The homeowner exercises an early buyout within 3 years at the higher of either a minimum 10% annual appreciation or market value.

If the homeowner sells the property at or above market value.

If the homeowner sells the property at or above market value.