Los Angeles, CA – 01/13/2026 – Vesta Equity, an innovator in digital real estate investments, today announced the successful execution of the first-ever on-chain, legally-perfected, digitally-native Home Equity Investment (HEI) on a public permissionless blockchain. The $100,000 transaction on the Provenance Blockchain, conducted between a California homeowner and an investor, was completed entirely on-chain in collaboration with NUVA Labs using ’ $YLDS, the first and only SEC-registered, yield-bearing stablecoin issued by Figure Certificate Company, a wholly owned subsidiary of Figure Technology Solutions, Inc. (NASDAQ: FIGR)(“Figure”).

Unlock Your Home Equity Debt-Free

Say no to the burden of debt and monthly payments. Access your equity without the need to go to the bank or sell your home.

Your Hard Earned Home Equity is Difficult to Access.

A debt-free option that makes a difference using our Equity Tap™ and Mortgage Exit™ solutions:

Fast & Simple Estimate

Get an instant estimate with a seamless online process. No hassle, no waiting—just quick qualification so you can access your home equity faster.

Quick Funding, Your Way

We make equity funding simple and fast!

Freedom to Live in Prosperity

Use your home equity to reduce debt, renovate, pay for college, start a business, invest, or take that dream vacation! It’s your home equity—spend it the way you want.

See How Much Equity You Can Access With Vesta Equity

How it Works

Vesta Equity enables homeowners access to the value in their property without debt. Unlock the value in your home with a Home Equity Investment. It's simple, straightforward, and puts you in control. Here's how it works:

- Tell Us About Your Home

Start by providing basic details about your property and your financial goals. Our simple onboarding ensures minimal paperwork and fast underwriting. - Receive a Personalized Offer

We’ll review your information alongside the Home Appraisal and Inspection. Once verified we'll present you with a custom Home Equity Investment offer—with no monthly payments. - Access Your Funds

Once you accept, we’ll finalize the agreement and fund your investment. You get a lump sum of cach up front without taking on debt and monthly payments. We’ll give you a full preview of any estimated fees before anything is finalized. - Grow Together

We share in the future appreciation of your home equity, so our success is tied to yours. You retain ownership and occupancy rights so you keep living in your home. - Settle on Your Terms

Either when you’re ready (whether it’s in a few years or down the road), or if you decide to refinance, sell or transfer your property you'll buy out our share of equity in your home. You stay in control every step of the way. Try our calculator below to get an instant estimate of debt-free cash you can get and to see how our equity share grows over time. - Customer Support

Every homeowner is assigned a dedicated Customer Success Manager as a direct point of contact throughout your HEI journey. - Timeline

We like to move quickly, but we also understand how important it is to be thorough. Our team will be there each step of the way!

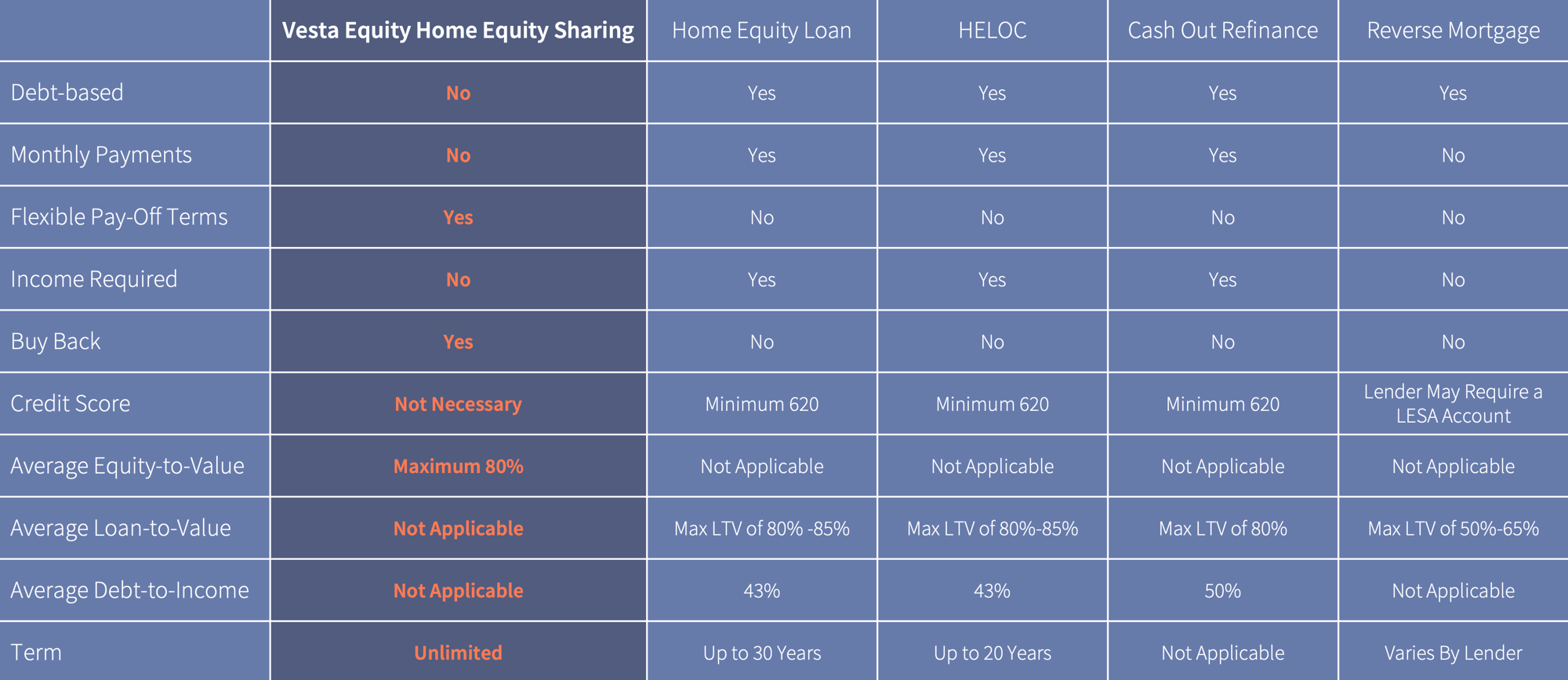

Home Equity Investments Compared to Traditional Financing

Leverage Your Home Equity to Your Financial Benefit

Unlock your home's potential to fund milestones, consolidate debt, grow savings, or invest. Take charge of your financial future and turn your equity into a wealth-building tool. Financial freedom starts here! Sign Up for an Informational call to learn how you can access your home equity without debt.

Aaron Stuiber

Head of Customer Success

Frequently Asked Questions

-

What does Vesta Equity do?

-

What is a Home Equity Investment?

-

What are the basic property requirements to qualify for an HEI?

-

How long does the process take?

-

Are there any income, age or employment requirements?

-

What's the minimum HEI I can accept?

-

What's the maximum I can receive?

-

How can I use the money?

Vesta Equity helps homeowners access their home equity without debt or monthly payments. Unlike traditional loans, our Home Equity Solutions like our Equity TapTM and our Mortgage ExitTM let you unlock funds while keeping full control of your home. We’re not a lender—we’re your partner, helping you leverage your home’s future value with investors and keeping banks and the burden of monthly payments out of the equation.

A Home Equity Investment from Vesta Equity offers you a flexible way to access the wealth in your home without loans or monthly payments. Instead of borrowing, you receive a cash payment upfront in exchange for a portion of your home’s equity future value. You remain the owner and can repurchase the investment anytime! It’s a modern, debt-free way to make your hard-earned home equity work for you.

- Property Type: Single Family Residence, Condominiums, Townhomes, Properties with 2-4 Units

- Value & Condition: Each property is subject to a full Appraisal and Inspection to verify value and overall property condition.

- Occupancy Status: Owner Occupied & Primary Residence

- Ownership Type: Individual ownership, LLC’s and Trusts subject to additional review.

- Location: United States. Reach out directly to confirm if your home's location qualifies!

Typical underwriting and final origination of a Home Equity Investment from Vesta Equity takes roughly 2-4 weeks. Get an HEI estimate in as quick as 5 minutes!

None! Because there are no required monthly payments, Vesta Equity does not require proof of income. Unlike a Reverse Mortgage, HEI’s have no age requirements, just as long as you're 18 years or older!

The minimum HEI Vesta Equity is able to offer is $25,000.

You can receive up to:

1. 30% maximum of the total home value.

or

2. 50% of the total home equity.

or

3. 80% maximum of the total home equity when combined with a senior mortgage.

How you use the money is completely up to you! Some common uses are eliminating debt, paying for home renovations, financing their children's education, covering medical expenses, starting a small business or supplementing retirement income.