Latest Content > Never Spend Your Money Before You Have It

Never Spend Your Money Before You Have It

Teaching our children and grandchildren how to be financially independent is one of the more important gifts parents can give. The underlying premise of these discussions is likely to be centred on saving their money and living within their means.

It sounds obvious, but we don’t typically teach children how to borrow, go into debt, and repay interest and penalties.

“Debt is so ingrained into our culture that most Americans cannot even envision a car without a payment, a house without a mortgage, a student without a loan, and credit without a card” - Dave Ramsey, Author and Radio Host

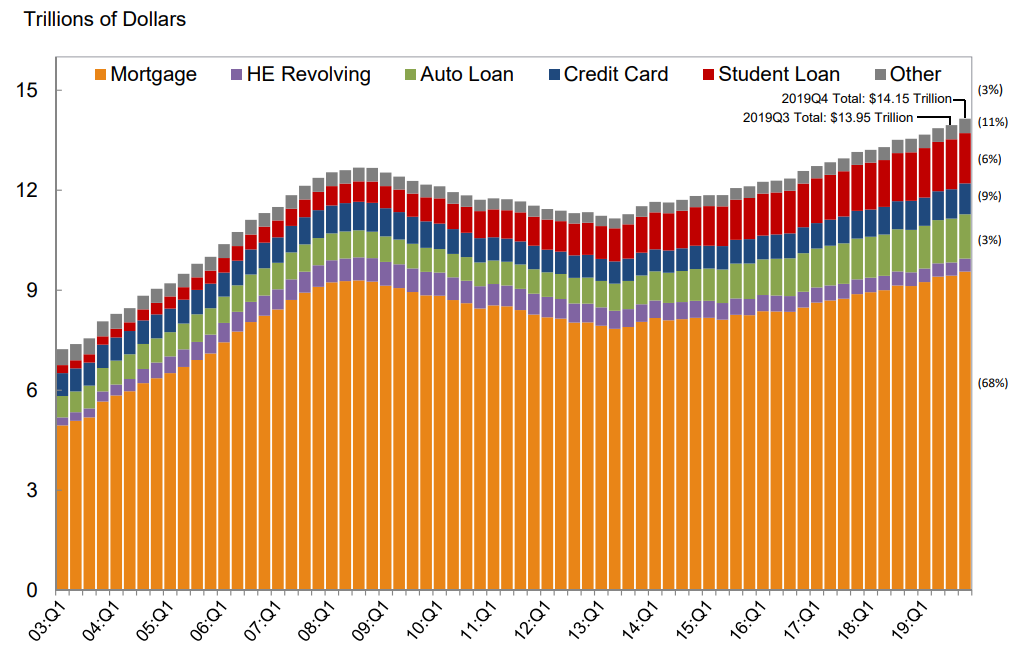

Despite this common knowledge, most of us participate in borrowing as soon as possible and never really stop. We graduate from student loans to home and auto financing, and by that time, we’re more than familiar with monthly credit card bills. We’ve become so familiar with borrowing that household debt is surging. According to the New York Fed, before the Covid-19 pandemic, household debt had reached an all-time high in the fourth quarter of 2019, with the growth in debt-driven by student loans and auto financing.

Household Debt Tops $14 Trillion as Mortgage Originations Reach Highest Volume Since 2005

While post-pandemic debt in these categories has cooled, these trends are beginning to return to normal as lockdown situations lift and spending habits resume.

Quarterly Report on Household Debt and Credit

Unsurprisingly, one of the most common reasons to take out a loan is debt consolidation. When saddled with multiple sources of high-interest debt, such as credit cards and payday loans, paying these off and managing them with a single monthly loan repayment can feel great. Using your home as a vehicle to access a lending product such as a HELOC or perform a cash-out refinance at lower interest rates can seem like a life preserver. However, while solving the short-term problem, the downsides of lending - initiating another set of hidden fees and making monthly payments - remain.

If you’re able to leverage your home for a loan, then consider not borrowing altogether. With Vesta Equity, you sell a portion of the equity in your house through a simple process and can use the proceeds to wipe out debt completely rather than transfer it. Fully retained residential rights mean that you can do this while continuing to enjoy the home you’ve worked hard to pay off. As more and more homeowners become home-equity rich and innovative, simple, and transparent methods to access home equity become available to homeowners, the idea of finally being to spend your own money won’t just be a lesson for our kids.

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog