Latest Content > Accessing Your Real Estate Wealth - Making Deals

Accessing Your Real Estate Wealth - Making Deals

One of the many joys of owning real estate is the freedom you have over making it yours. We’ve all gone through the stages of putting posters up in our childhood rooms, painting our first apartments, and choosing tiles for our home’s bathroom reno. The growth of the DIY economy is a reflection of how much we like to customize our living space. We don’t think of exercising the same control over how we finance our homes, but Vesta Equity’s platform allows you to do just that.

In our first post of this series we covered how to get started with Vesta Equity and described account creation, onboarding, how to publish a listing, and how property investors can find it. In creating a listing, the owner sets the main deal terms which are the percentage of equity in the property they’d like to list and the dollar amount they’re selling it for. As an example, an owner has a property valued at $500K and is interested in selling 25% at market value, or $125K. Of course, they have the freedom to list any percentage and do so above or below market value.

“A desire to be in charge of our own lives, a need for control, is born in each of us. It is essential to our mental health, and our success, that we take control.” - Robert F. Bennett

On Vesta Equity’s marketplace, property investors are able to search for listings using attributes such as region or property valuation. Once on a listing page, they can browse it and consider whether the listed equity is an asset they want to have in their portfolios. If the answer is yes, they can then submit an offer for all of the equity or a fraction of what’s listed. They can also submit their offer at the listed amount or propose a different amount altogether. Vesta Equity’s aim is to connect property owners and investors, and let them decide on a deal that makes sense for them.

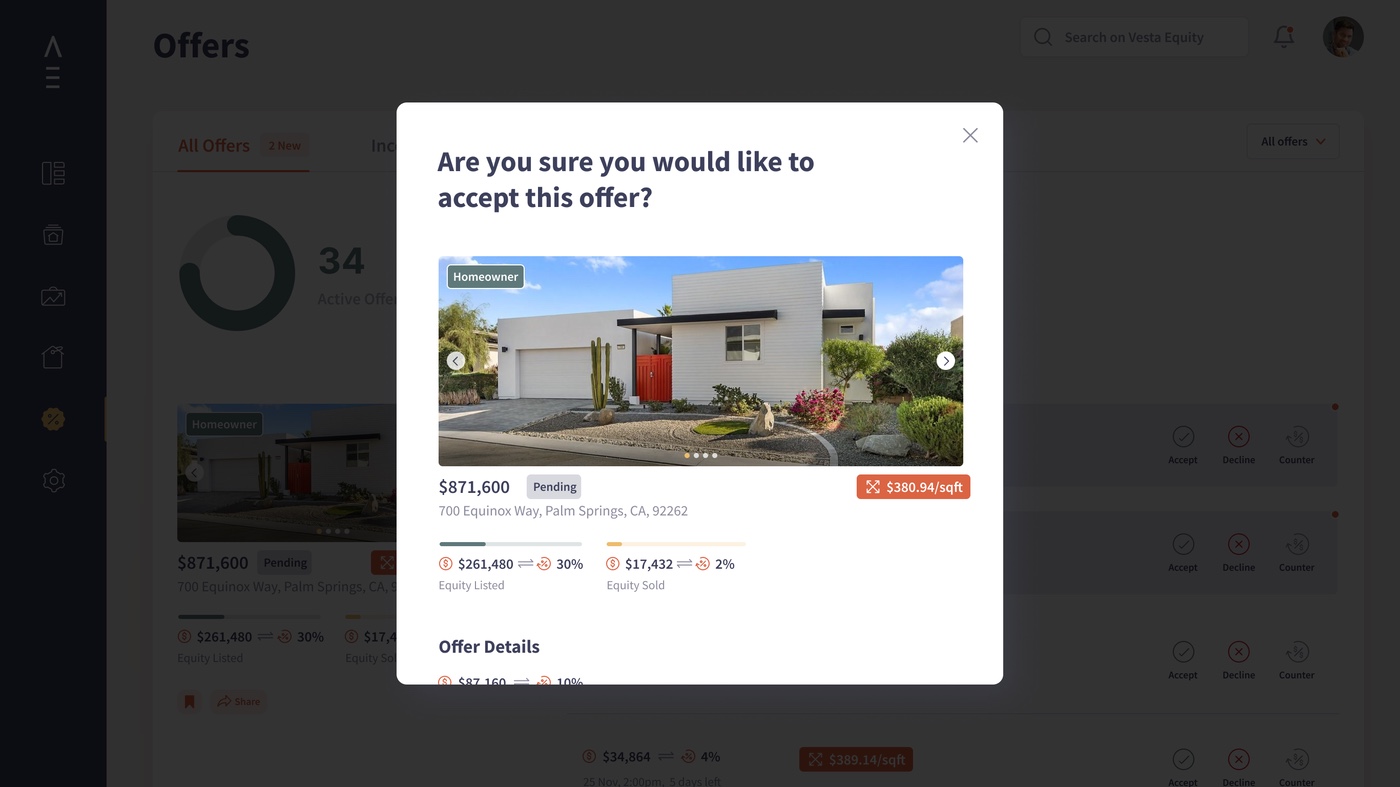

Let’s use the same example above with a $500K property where the owner wants to sell 25% equity at market value, or $125K. Investor A submits an offer for 5% at $25K while Investor B submits an offer for 5% at $30K. Investor C might desire a larger amount at a discount, say 10% for $45K. Each offer would be submitted with a time window that the offer is valid for. The property owner would be notified on each offer and proceed to evaluate them individually. The choice is completely theirs to accept or reject. Alternatively, the owner can submit a counteroffer by changing the deal terms. In this case, the investor would then consider the counteroffer within the time window that the property owner sets.

To ensure the offer’s integrity, Vesta Equity freezes the assets being offered by each party. When an investor makes an offer, the funds specific for that offer are verified in their wallet prior to offer submission and are placed in escrow during the selected time window. If the offer is accepted then the funds continue into settlement. Alternatively, the funds are released if the offer is rejected or the time window expires. The investor cannot make other offers during the holding period using those same funds. Similarly, when a property owner makes a counteroffer the equity assigned to the counteroffer is also frozen during the time window until the investor takes action. The owner cannot make counter offers for equity amounts exceeding what’s available.

How likely an investor is to submit an offer, or accept a counteroffer, depends on marketplace dynamics, broader market conditions, and individual needs. Investors on Vesta Equity are looking to build a portfolio of real estate assets that they want to mature based on an investment thesis that factors in the overall time horizon and potential yield. They may have deep insight into hot markets or simply be looking to diversify across multiple markets. A great way for property owners to think about listing equity is to consider other comparable listings on Vesta Equity, the property’s valuation forecast, and of course their own short and long term financial goals.

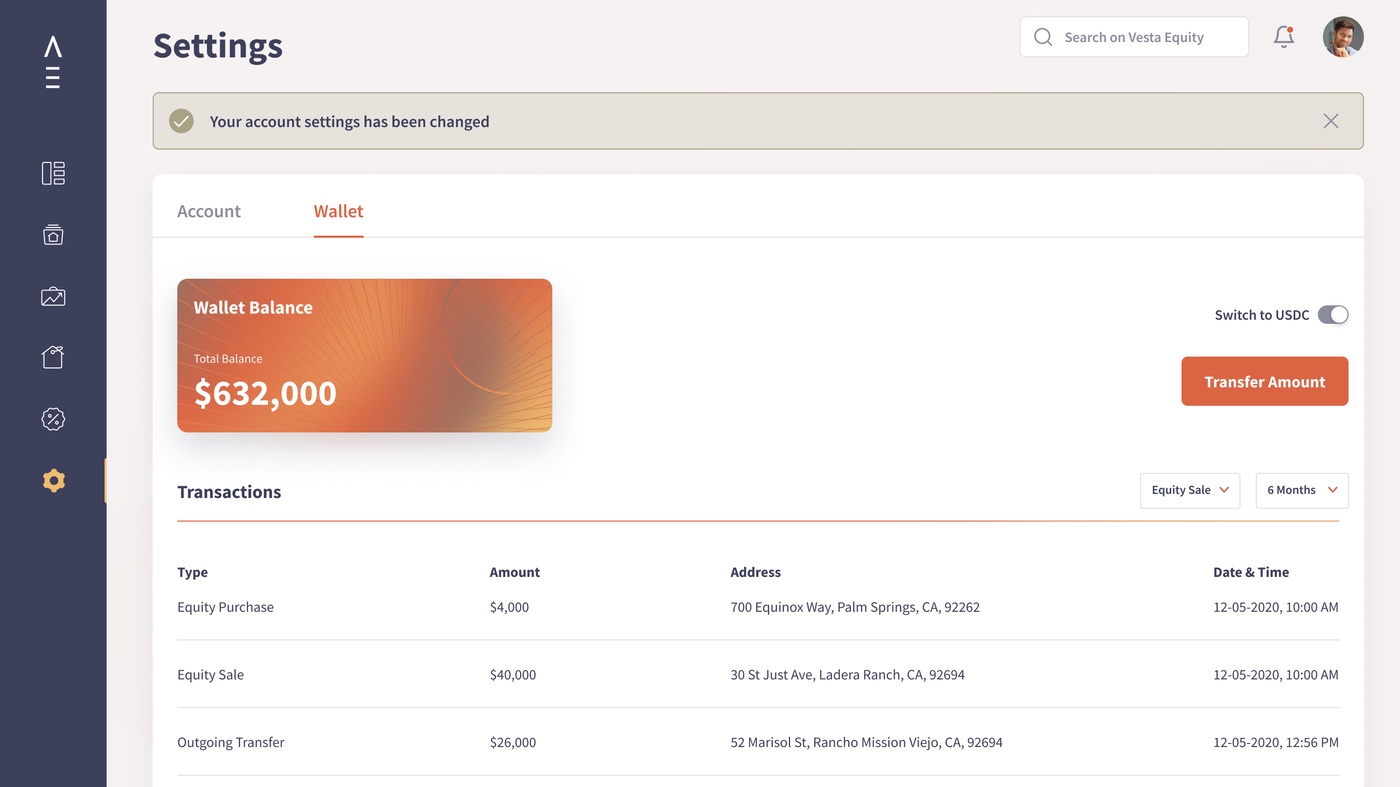

Once the property owner agrees to an offer, the settlement process takes place whereby investors’ deal funds are directed to the property owner’s wallets. Settlement is rapid and transacted in USDC which is pegged 1:1 with the US dollar. From there, the owner can move some or all of the USDC out of their wallet and into a connected bank account, in US dollars, at their convenience. We know that property owners are looking to sell equity because they want access to those funds as soon as possible so the settlement process was built to be fast and simple.

Now that we’ve covered making deals, in the next part of our series we’ll look at how to fine-tune listings with the buyback feature, re-list equity in the same property, and manage multiple properties.

Vesta Equity is launching soon. To register as a property investor visit https://vestaequity.net/investors/ or alternatively as a homeowner looking to access your equity debt free https://vestaequity.net/homeowners/

Sign up to get alerts about new posts

What’s New

Vesta Equity Market Recap 19.0

Stay informed and make informed decisions with Vesta Equity's Real Equity Marketplace Update 19.0, foreseeing trends.

Read Blog

Read Blog